Previously on Free from Broke, Glen has touched on the subject of dollar cost averaging as an effective way to buy new shares of mutual funds for retirement accounts (401ks and IRAs) several times.

Indeed, from an emotions and mathematical standpoint, dollar cost averaging makes sense.

Because of the simplicity and sensibility of the method, it is safe to say that there is a large amount of people who believe in and employ dollar cost averaging on a frequent basis to invest for retirement. So, after being convinced of the merits of this investing strategy, the important question then becomes…

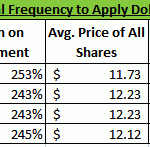

What is the Most Efficient Way to Employ Dollar Cost Averaging?

[Read more…] about What is the Most Efficient Way to Use Dollar Cost Averaging?