We were real close to closing on the sale of our co-op.

As result we needed a place to move to. These days landlords and realtors tend to ask for a recent credit reports and scores in order to rent from them. Rather than pay each time we find an apartment we liked, we decided to check our credit reports and scores ourselves to have on hand if needed. We were also curious to see our credit scores and of course we wanted to make sure our credit reports were accurate.

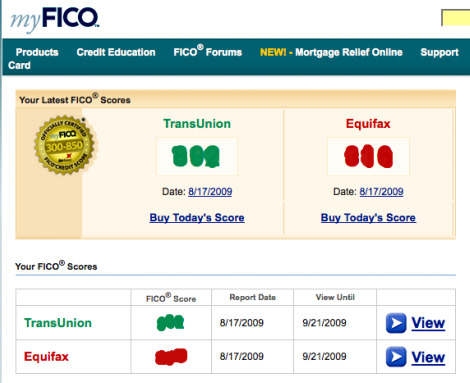

We purchased both our credit reports and credit scores from myFICO. They provide you with your FICO credit scores for two of the three main credit reporting agencies: TransUnion and Equifax. Experian no longer allows customers access to their FICO scores.

Sure you can get a free copy of your credit report from AnnualCreditReport.com but we wanted to also see our credit score.

Quick credit report vs. credit score review:

A credit report tell you what credit accounts you have open and the status of the accounts such as whether you have paid on time. It can also tell you what the balance is on the accounts. These are important to check to make sure they are accurate and that there aren’t any fraudulent accounts you may not be aware of. If there are mistakes then these can have a huge negative impact on your credit score so it’s important to take care of them.

A credit score is a measure of how credit worthy you are. The credit score range goes from 300 (good luck getting a loan) to 850 (here, you need a loan, take some money!). Obviously the higher the better. It’s important to know your score so you can know what kind of rate to expect when applying for a loan. Also, knowing your score puts you on better ground as a creditor may not be honest about the rate you actually qualify for.

myFICO Review

So back to myFICO: We used them when we checked our credit reports and credit scores before we bought our car so we knew what to expect and trust from myFico.

Let me tell you, their reports are excellent! Very comprehensive and easy to understand. Here is the summary page showing my scores (I’ve blurred mine out):

Notice that you have access to your FICO score for about a month. This way if you can print it out more than once. From here you can also view your scores. This gives you a summary of your score, an understanding of what helps and hurts your score, and a picture of how a potential lender might see you and what you could expect as a loan rate with your score.

Next up you can see your credit report.

First you see a summary of your report: Personal information; accounts past due; credit history; late payments; total balances; and basic total numbers on your accounts. Next you get a listing of your actual accounts which shows the status of the account, balance, and if its been paid late. You also have the option to see a detail on each account. The page after shows who has submitted an inquiry on your account. This is important because too many inquiries can hurt your credit score. Then you can see if any of your accounts have been sent to collections. I think it goes without saying that you don’t want any accounts showing up here. Then up are public records reported on you. These can be bankruptcies, tax liens, or garnishments. Keep an eye out here because these can negatively affect your score. You want to make sure this information is accurate!

At any point if you believe that any of the information is incorrect then myFICO has a link that can help you dispute the errors.

Did I mention we purchased our reports and scores from both TransUnion and Equifax?

You might ask “Why order from both companies?” Good question! What can happen is a creditor might only report your history or a problem to only ones of the credit agencies. If you only order from one agency you may not see all of the activity out there on your reports. Also, each agency reports their scores slightly different. If all information is correct then your scores should be similar but you never know what could show up on one and not another that could be affecting you.

So do I recommend myFICO?

Absolutely! I’ve used them a number of times and I am very happy with the reports. I’ve used the credit scores and reports a couple of times now to help negotiate financing for cars I’ve bought.

Let me tell you about the first car I bought. The finance manager was trying to give me a high loan rate. I told him “really, but my credit score is xxx.” He looked at his screen and said “oh yeah” like he hadn’t noticed before. He then lowered the rate to what I was expecting. See, he was trying to take advantage of me and didn’t think I was savvy enough to know my score. By checking my FICO score before buying my car I was able to save possibly hundreds in interest.

Don’t let a lender take advantage of you! Know your FICO score!

Click here to get a 10-day free trial to myFICO’s Score Watch®.

There’s a direct correlation between your credit report and your credit score. Your credit score is calculated based on your entire payment history and everything else that appears in your credit report, so maintaining timely loan and credit card payments and not going on spending binges will directly impact your credit score (in a positive way).

Absolutely! Seriously, paying on time is huge.

Why did you choose to go to MyFICO vs. going directly to equifax and Trans Union? Was it cheaper?

.-= Jessie´s last blog ..So now what? =-.

From what I understand, myFICO is the only place to get your credit score without having to purchase something else like a credit monitoring program. I don’t see the option to getting your score at TransUnion or Equifax.

If you know different I’d love to know!

The only downside to myFICO.com is that they no longer show you your credit score based on your Experian credit report data (FICO and Experian had a falling out a while back). So while it’s great to see your TU and Equifax score, you won’t be able to get your FICO Experian score anymore.

.-= Carrie Davis´s last blog ..Bad Poetry Contest Winner =-.

This is true. But I don’t think you can get your FICO score from Experian either. And I’ve heard that some vendors have discounted the Experian score. They offer a score but I think it’s their version.

I like to check on a 3-bureau score. I go to one of the three bureaus and get a full report from all three, plus all three scores, for right around $50. I do this to supplement my free annual credit report from each of the three.

.-= Miranda´s last blog ..NOW is The Time to Start Holiday Shopping? =-.

Are all three FICO scores? Just curious. I’m sure there must be other places to get your FICO score I’m just most familiar with myFICO.

How much does it cost?

.-= Joe Morgan´s last blog ..How to Avoid Debt After Death. =-.

Currently the FICO Standard option is $15.95 per agency (you pay once for TransUnion and Equifax). I was able to find a discount code online which lowered the price to under $50 for both my score and my wife’s from both agencies.

You can go directly to http://www.transunion.ca/ or https://www.econsumer.equifax.ca/index_en.html to check your credit scores.

with transunion.ca you can get JUST your score for $7.95, you can get your score and an interpretation of it an ‘analysis’ for $14.95.

with equifax.ca you can get your credit score and and credit report for $23.95

You have the option to get a ‘credit watch’ feature with either, but you don’t have too. I choose not too b/c I’m not so worried about it. I’ve checked once before, and plan to again in the next month or so now that my credit card is paid off.

.-= Jessie´s last blog ..Go house fund go! =-.

I haven’t used MyFico yet, but I have used the Equifax service. It’s always good to keep up with your scores. 🙂

.-= Patrick´s last blog ..Where to Open a Roth IRA Account =-.

I think so. Especially if you have a major purchase coming up!

You can get your Experian credit score for free at Quizzle.com.

I just checked out the Quizzle site and they do offer a credit score for free but I don’t see anywhere that’s it’s a FICO score (the agencies sometimes have their own version which isn’t what many lenders use).

Do you know that the score you get is your FICO score?

A long time ago, someone tried to take my identity! I froze my credit the next day and everything was fine, but it really scared me. I periodically check m reports ever since.

For sure, I think you should check your credit reports every year to make sure they are accurate.

So everyone reading this is clear, MYFICO.com is the ONLY website where a consumer can access their TRUE FICO score(the same one that reflects what lenders use). All other websites, Experian.com, transunion.com, Truecredit.com, Quizille.com, etc., do NOT give you a FICO score.

These websites do give you your accurate credit report, but their scoring system for their ” credit score” is NOT a true FICO score.

I currently am monitoring my credit, and use myfico.com for my “true score”. I also am signed up for both Experian.com, and Truecredit.com(transunion score formula), but am aware that while i am given a score by their scoring system, that differs from the true FICO score that a lender uses when looking into my credit .

I chose to sign up for Experian.com to get an idea for my credit score, and Truecredit.com was the first credit monitoring service I subscribed to before learning they did NOT use the same scoring formula that its used for the FICO score.

Myfico.com is great! very easy to understand and 100% accurate.

Rasheda is correct! Reread her posting right now. You DO NOT get your true scores from any of the other monitoring services or credit score services found on-line. There is only one place that you can get your FICO Score and that is from MyFICO. All the other scores can be called a FACO score.

Lenders do not use the scores that you find or obtain from the credit agencies or a third party company. The agencies use their own formulas to give you a consumer credit score. That score is almost always different than the ones that your lender will use. The FICO score comes the closest to what will be used to obtain credit. Again, Rasheda put it very well so reread her posting right now.

Make sure you cancel your trial subscription immediately else you will pay hefty penalty and you will not able to get out of it. I recommend to stay away from it. Just go to one of the credit report company.

MyFICO may SEEM like an ideal source to check a credit score, however, the cancellation process is painful. After being on hold for 30 minutes I was able to successfully cancel my account, however, they required another call to cancel my husband’s account. Seeing as I, like the majority of Americans, do not have an extra hour to spend on hold, I would suggest avoiding MyFICO at all costs.

Thanks for your post, very useful information!