A Roth IRA can be a great way to build up retirement savings.

One of the great advantages is that since you are putting money in after it’s taxed you get to take the money out, in retirement, tax-free. And that includes the money’s growth over the years as well.

Another great advantage to the Roth IRA is that you can take out the contributions you put in without any penalties. This is due to the fact that you have already paid taxes on that money (opposed to a traditional IRA where you put pre-tax money in and get the tax break now).

As wonderful as the Roth IRA can be you can only put so much into it each year and there are limits to how much you can make as well.

Congress is always tinkering with the tax code and making changes nearly every year and in nearly all categories, and that includes Roth IRA contribution and income limits.

Below are the Roth IRA contribution limits for 2012.

Contribution limits

Contribution limits for 2012 are one of the few things that haven’t changed from 2011.

The maximum contribution for 2012 remains $5,000, or $6,000 if you’re aged 50 or older (the “catch up” provision).

You can make contributions to both a Roth IRA and a traditional IRA, but there are a couple of considerations to keep in mind:

- Your combined contributions to both plans cannot exceed the maximum limit for either account individually. Put another way, you’re combined contributions to the two plans cannot exceed the $5,000/$6,000 limits.

- The income limits for contributions to the two plans are different, so proceed with caution if you go this route.

Income limits

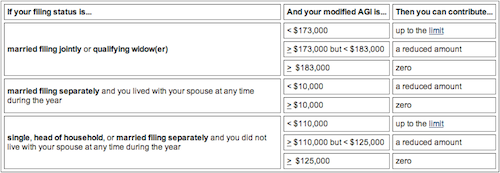

Income limits for eligible Roth IRA contributions for 2012 are, as they have been in the past, dependent on your filing status.

Single, head of household, or married filing separately and you did not live with your spouse at any time during the year: Full contributions are permitted up to a Modified Adjusted Gross Income, or MAGI (more on this later) of $110,000. Contributions are phased out between $110,000 and $125,000, and after $125,000 they’re disallowed completely.

Married filing jointly or qualifying widow(er): Full contributions are permitted up to a Modified Adjusted Gross Income, or MAGI of $173,000. Contributions are phased out between $173,000 and $183,000, and after $183,000 they’re disallowed completely.

Married filing separately and you lived with your spouse at any time during the year: This one is punitive—there isn’t much of an income limit here at all. You can make a partial contribution on an income under $10,000. Once you reach or exceed $10,000 you are not permitted to make a contribution.

The chart below from the IRS summarizes the Roth IRA Limits for 2012:

What is MAGI, or Modified Adjusted Gross Income

You’ve probably noticed the liberal use of the moniker, MAGI in the preceding section, and as you might have guessed, this isn’t something to be taken lightly.

In fact, this is where Roth IRA calculations can get a bit complicated.

When IRS regulations discuss income in connection with Roth IRA’s they don’t mean gross income (what you and I understand to be income) or even Adjusted Gross Income, or AGI (the common IRS definition of income as calculated on the last line of Form 1040 page 1).

They mean adjusted gross income, plus or minus a few other things—some uncommon, some not so uncommon.

So how do you determine your MAGI???

You start with your AGI—you just have to love the many IRS monikers—then add and subtract from there. When you’re done, you’ll have your MAGI, and only then will you be in a position to know if you fully qualify for a Roth IRA contribution.

The best way to approach this is to see how the IRS says to compute MAGI:

Modified adjusted gross income (MAGI) for FORM 8582 line 7 is determined by computing AGI without:

- Any passive loss or passive income, or

- Any rental losses (whether or not allowed by IRC § 469(c)(7)), or

- IRA, taxable social security or

- One-half of self-employment tax (IRC § 469(i)(3)(E)) or

- Exclusion under 137 for adoption expenses or

- Student loan interest.

- Exclusion for income from US savings bonds (to pay higher education tuition and fees)

- Qualified tuition expenses (tax years 2002 and later)

- Tuition and fees deduction

- Any overall loss from a PTP (publicly traded partnership)

As you can see from this lengthy list of modifications, it’s entirely possible that the income you use to qualify for your Roth IRA contribution may not look remotely like your adjusted gross income, to say nothing of your actual gross income.

One final note: since these calculations can get fairly complicated, and since provisions DO change, if you think you may be coming up on the Roth IRA limits it is strongly recommended that you discuss your Roth IRA contribution plans with your tax advisor. The penalties for over-funding or making a contribution erroneously are substantial.

I am on ss. I have money in other funds that I want to put into ROTH IRA. I am a self employed beautician and make a small amt of income. Usually net about 4-5 thousand each year. Isn’t there a limit to the amount I contribute based on my self employed income.