A Roth IRA can be a great way to build up retirement savings.

One of the great advantages is that since you are putting money in after it’s taxed you get to take the money out, in retirement, tax-free. And that includes the money’s growth over the years as well.

Another great advantage to the Roth IRA is that you can take out the contributions you put in without any penalties. This is due to the fact that you have already paid taxes on that money (opposed to a traditional IRA where you put pre-tax money in and get the tax break now).

As wonderful as the Roth IRA can be you can only put so much into it each year and there are limits to how much you can make as well.

Congress is always tinkering with the tax code and making changes nearly every year and in nearly all categories, and that includes Roth IRA contribution and income limits.

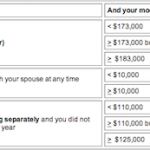

Below are the Roth IRA contribution limits for 2012.

Contribution limits

[Read more…] about Roth IRA Contribution and Income Limits for 2012