Having a good credit score impacts many areas of your life: the interest rates you pay on debt, your car insurance rates, and what types of credit card offers you get in the mail.

If you find yourself with a poor credit score, but have a need to improve it quickly, there are a few tips you can try.

However, the only true way to drastically improve your score is to use debt responsibly for a long period of time. There are some ways that can help speed up how you improve your credit score. Do these right and you might just raise your credit credit score by 100 points fast!

What Goes Into a Credit Score?

Before you can improve your credit score you need to know what exactly goes into your credit score in the first place. Once you know what goes into the credit score you can work to make changes in those specific areas.

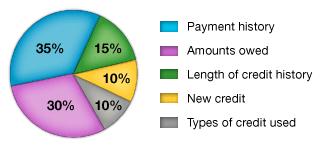

We have a full post that dissects what goes into your credit score, but here’s a brief breakdown:

We have a full post that dissects what goes into your credit score, but here’s a brief breakdown:

- 35% – Payment History

- 30% – Amounts Owed

- 15% – Length of Credit History

- 10% – New Credit

- 10% – Types of credit used

How to Improve in Each Credit Score Area

Improving your credit score comes down to improving the individual pieces of what goes into a credit score.

If you have problems in one or two of the areas, you should focus your efforts there first rather than running down the list. Likewise you should prioritize your efforts on the areas that have the biggest impact on your score.

For example if you have problems with your payment history, that should be your first priority because it has the largest impact on your credit score.

Here’s how to quickly improv your credit score in each area:

Payment History

One of the fastest ways to crash your credit score is to not pay your bills on time or at all. Having a creditor ding your report for a late or delinquent payment can hurt your score immediately.

Only problem? It takes time to repair your credit history.

Even if you have an account sent to collections that you are able to get current on or pay off, the mark stays on your report for 7 years.

Want to improve your score in this area?

Set up automatic payments for all of your bills. Behind on payments? Call the creditor to work on a plan and start making payments to catch up.

Another problem to look out for are errors on your report that are incorrect. There may be a late or even delinquent mark on your credit report that isn’t accurate. In that case you need to contact the creditor to get them to remove the incorrect data.

[Related: Where You Can Get Your Credit Score Free]

Amounts Owed

While payment history is more difficult to repair due to having to wait for time to pass, changing amounts owed is something you can start fixing right now.

You probably don’t have the best score if you are maxed out on three different credit cards. The bureaus compare what your credit limit is for the debt (say, $5,000 on a credit card) and what you currently owe (say, $4,800). Your credit utilization is sitting at 96% — way too high.

Want to improve your score in this area?

Pay off debt.

It sounds simple, but can be difficult. Start chipping away at your debts to not only improve your credit score, but save yourself a lot of money in interest charges. Focus on revolving credit (like credit cards) first, specifically on those with either low balances (so you can build psychological momentum on your debt payoff plan) or high interest rates (to save the most interest).

Also — and this is key — don’t close your credit card accounts after you pay them off. You can pay off the balance and cut up the card while still keeping the account open. This leaves your credit line intact, which gives you more total available credit to contrast what you owe against.

This brings down your credit utilization ratio, which is a good thing.

Length of Credit History

Having a credit card for 15 years that you regularly use and pay off is a good thing.

But again, it takes time to get there.

It can be tempting to open up a bunch of accounts all at the same time to increase your credit available (to help out your credit utilization from above), but doing this can actually hurt your score because it looks risky. Unfortunately, there isn’t much you can do here other than keep your accounts open and in good standing.

New Credit

If you need to get a loan of some kind, it is wise to price shop to compare rates from various lenders.

However, in seeking new credit you want to limit your inquiries to a small period of time. Don’t shop for a car loan for three months and spread out 12 inquiries over those three months. Shop for the loan in one month and make a decision.

Opening one new account (like a credit card) and paying it off each month can, over time, raise your credit score as well. But if you have bad credit it may be difficult to get new credit accounts. You may be asked to open a secured credit card instead.

[Related: Some of the Best Secured Credit Card Offers]

Types of Credit Used

Having a wide array of responsibly used credit is better than having only one area.

This is why avoiding credit cards altogether can actually hurt your credit score. (Granted, if you know you can’t handle credit then avoid it completely. There’s no sense in paying interest in the name of having a better score.) This also is another indicator to not close out all of your credit cards after you pay them off.

You may be tempted to open new types of credit in order to increase your credit diversity. This only works in certain cases, but can be beneficial if you go from not having any credit cards to having one. Just don’t go overboard and go from zero to six cards all at once; again, you will look more like a credit risk.

Finally

Though there are techniques you can use to improve your credit score fast, the best way to improve your credit is to take a good look at your spending habits and work on lowering your debt and making sure you always pay on time.

Be it slow or fast, increasing your credit score should be a goal since a better score can potentially save you a lot of money.

One trick I use is asking credit cards to increase your limit. Assuming you don’t charge more your credit utilization ratio will improve and raise your score!

Thanks for the tip, Lance. I haven’t tried this one yet, but it makes sense.

Luckily, I’ve never really had to worry about my credit score because I’ve never been late on payments. However, I would caution people to avoid using debt simply to increase their credit score. I would much rather have a lower score and no debt than a high score with tons of debt. IMO, you’re better off in the long run to avoid debt completely and pay cash.

I agree with you Greg, I too wouldn’t advise anyone to use debt to increase their credit score. You could be just one missed payment away from decreasing your credit score to a worse number than a person with no credit. Indeed, you are better off using cash. Most people who use credit just make their minimum payments, which increases your risk of getting a lower score.

Supercharging the utilization tip – you can transfer balances to make sure you don’t have one card that is close to its limit

No, Evan, that won’t work. Credit utilization is based on your total available credit, not on a per card basis. Transferring balances will have ZERO effect on your utilization rate. All transferring a balance away from a nearly maxed out card will do is increase the available credit on that card while decreasing it on the card you transferred it to.

Good point Dave, but what about transferring the balance to a new card? Then you are moving the balance (remains the same) but and the new card gives you more credit to raise your overall available credit, thus making your actual balance a smaller percentage of available credit.

Of course you need good credit to get a good balance transfer offer (0% APR would be best) and you don’t want to risk applying for a card and getting turned down.

Most of the ways to improve your score quickly require cash: money to get current on any debt obligations first, and reduce balances on credit cards second.

The only option that does not require capital is to review your report for any errors. The most common problem is the mixing and separating of files. Sometimes data is in two reports or more, other times data from other people gets mixed in.

I was able to raise my credit score after I got a couple of secured credit cards who reported to the credit bureaus. Great article and thanks for the write-up!