I received my American Express Blue bill recently.

When I opened it up the bill looked a little different. To my surprise there was specific information that now appeared as a result of the new credit card rules from the Credit Card Act that took effect in February.

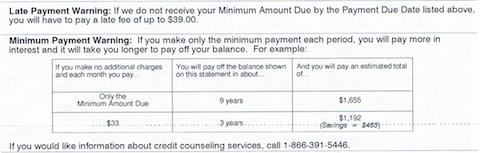

Check out this section of the bill that appears on the first page (about two inches down from the top of the page):

This is all new as a result of the credit card act! Pretty interesting, huh? Let’s take a look at each part that’s new:

Late Payment Warning

Credit card issuers must give a full disclosure of late fees. I pulled out last month’s bill and I couldn’t find the late fee anywhere in the bill. Now the late fee is quite prominently displayed right below the amount due. Paying $39 for a late payment is a pretty hefty fine (its actually more than double what the minimum due is). This should help wake people up to what happens if they pay late!

Next part…

Minimum Payment Warning

This section is really interesting! Credit card companies must now tell consumers how long it will take to pay off the balance if only the minimum is paid and how much interest it will cost them. I think this is where people can really wake up and see how much their credit card debt is costing them! Before we look at the two calculations you need a couple of figures: my total bill is $951.56 for the month; and my minimum due is $19.

Now take a look at what happens if I only pay the minimum amount due – It will take me 9 years to pay off the balance and I will pay about $1655 in total!! I would only be paying off about $100 a year and it would cost be about 75% more! What?!? Imagine if you saw a sale sign at a store that said “Buy now and get 75% added on!” Now consider the fact that these are what the costs are if I don’t charge anything else to the card. If I added more in the next month and so on then it would take me that much longer to pay off and cot that much more.

If I pay more than the minimum amount, a little less than double or $33 in their example, I could pay the balance off in 3 years and it would cost me $1192 overall. Check out where they say its a savings of $463. A real bargain!! I hope its obvious that your best bet is to pay off your card in total every month.

And lastly…

Credit counseling

This little bit here gives a phone number for people who want information about credit counseling. I like that this is included and I think it will help a few people but I can’t help thinking its like a warning on cigarettes or like the gambling problem notices you see all over Las Vegas – If this is something you are addicted to it will be very difficult to call the number!

Personally I think this is a move in the right direction. The Minimum Payment Warning should do a lot to help people with their credit card debt. I know if this was in place back when my credit cards were full of debt I would have realized sooner what my debt was costing me and how one more music CD was going to cost me so much more than I thought. It makes me think of the times I thought I was being smart getting something on sale but in reality I was paying so much more than I thought.

What do you think about these credit card bill changes? Will it help consumers? Have you noticed any other changes on your credit card bills?

I like the added information on credit card statements. I really think the section that shows how much it will cost if you only pay the minimum will be a real eye opener to a lot of people. Hopefully it will encourage people to pay down their debt faster.

.-= Mike – Saving Money Today´s last blog ..What Adam Sandler Taught Me About Priorities =-.

We’ll see, but I agree that it should help. To hear that credit card interest is bad is one thing but to see an actual calculation of how long it takes and costs should go a long way n teaching people about their debt.

39 bucks isn’t cheap. Add to that interest. I missed paying by 6 hours. It cost me close to 50 bucks total. It will not happen again.

Now i think people will endeavor to pay off their debt faster. Many people under look the effect of accumulating debts.

.-= harvestwages´s last blog ..Entrepreneurship As a Corporate Value =-.

I like the new disclosures. I’ve never carried a balance, but I think it’s better to disclose the negatives than hide them from credit card users that may not have done the math for themselves.

.-= Budgeting on the Fun Stuff´s last blog ..Do You Have Unclaimed Cash with the IRS from 2006? =-.

Sometimes doing the math can be difficult too. You have to figure out the exact rate and how the balance compounds. Its much better now that they have the payoff amounts in there.

I think the new credit card laws are awesome. I am a little worried though because I have heard that credit card companies are already looking for loopholes in the legislation so that they don’t have to follow them…

.-= The Penny Hoarder´s last blog ..Free Money Alert! – Get $25 Cash at ING Direct =-.

I haven’t heard about them looking for loopholes but I have heard about them raising rates before the act went into effect and I’ve heard the possibility of us seeing more cards with fees and less perks as a way for them to make more money.

Thanks for announcing this credit card update. Card users should now be alerted not to become responsible buyer but also to become more responsible borrower. We know that we are using credit cards, and the CC companies earn from people’s use of these cards. This is actually a mutual benefit for both CC companies and users.

.-= Victorino´s last blog ..How to save money on your date? =-.