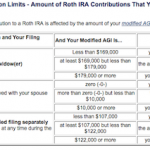

An IRA can be a great tool to help you save for retirement and the traditional and Roth both have interesting tax advantages. But the amount you can contribute every year is limited. The Federal government imposes limits as to how much money can be contributed to both the Roth IRA and the traditional IRA accounts. An account holder’s age (and income) is also a factor in how much s/he can contribute per year.

The investors who are 49 years old or younger have had maximum limits that are $1,000 less that those investors who are 50 years old or older since the 2006-2007 investment year.

The nature of this investment fund demands that an investor contributes the maximum amount of contribution allowed every year in order to enjoy maximum yield. For example, the contribution amount for a person 49 years of age or younger in 2010 was $5,000. If he only invests $3,000 in 2010 he can’t add the $2,000 deficit to the $5,000 contribution allowed in 2011. The IRA is a “use it or lose it” investment fund which means any money not invested into an IRA is lost forever. [Read more…] about IRA Maximum Contribution Limits – Roth and Traditional