Previously on Free from Broke, Glen has touched on the subject of dollar cost averaging as an effective way to buy new shares of mutual funds for retirement accounts (401ks and IRAs) several times.

Indeed, from an emotions and mathematical standpoint, dollar cost averaging makes sense.

Because of the simplicity and sensibility of the method, it is safe to say that there is a large amount of people who believe in and employ dollar cost averaging on a frequent basis to invest for retirement. So, after being convinced of the merits of this investing strategy, the important question then becomes…

What is the Most Efficient Way to Employ Dollar Cost Averaging?

In order to sufficiently answer this overarching question, there are two issues that we need to analyze and address:

1.How often should you make contributions through dollar cost averaging to your IRA or 401k?

- When it comes to investing in your IRA or one of the many options for small business retirement accounts, it is pretty much up to each individual on how often he or she wants to make contributions.

- The options for this that we’ll explore below are daily, weekly, biweekly, and monthly.

2. When you make new contributions using dollar cost averaging, should you purchase 100% equity mutual funds, 100% fixed income funds, or a mixture of both asset classes with the new money? In other words, if you have a certain fixed asset allocation that you are trying to maintain through periodic portfolio rebalancing, how should new contributions affect (or not affect) that allocation mix?

In order to answer these questions above, we’ll need to apply several assumptions to get started on a 20 year performance analysis:

- First, we’ll assume that there are only two available options for you to invest in (one equity and one fixed income mutual fund) –

- Vanguard S&P 500 Index Fund (ticker symbol: VFINX), and

- Vanguard Long-Term Treasury Fund (ticker symbol: VUSTX).

- Second, we’ll assume that you only analyze and rebalance your portfolio every 6 months back to your target asset allocation.

- Third, we’ll assume that your target asset allocation is 60% equity and 40% fixed income for the 20 year duration of the analysis (1992-2012).

- Fourth, we’ll assume a $10,000 starting account balance, that you contribute $1000 per month (every 4 weeks/20 market days) to your retirement account, there are no transaction fees, and that you have no other accounts to consider in the analysis.

Optimal Frequency of Contributions Through Dollar Cost Averaging

To figure out the optimal frequency (daily, weekly, biweekly, and monthly) to apply dollar cost averaging to one’s personal finances, we must first make one more assumption about how we will invest each periodic contribution. For now, we’ll assume that we purchase $500 equity and $500 fixed income new shares with each dollar cost averaging contribution of $1000 (so, 1/2 to each asset class). However, after we answer the frequency question, we’ll revisit these asset class splits again below.

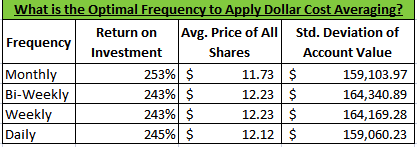

If we assume a $10,000 starting portfolio value (and the other pertinent assumptions listed above), we obtain the historical performance results shown in the table below for the 4 portfolios during the 20 year period from 1992-2012.

Included on the table are 1) the overall return on investment, 2) the average price of all shares purchased during the 20 year period (a lower price is better!), and 3) the standard deviation of the account value during the period (can be thought of as risk and account volatility).

- As we can see in the table, making monthly contributions through dollar cost averaging resulted in the best/optimal/highest return on investment and lowest average cost of shares.

- The risk/volatility (standard deviation) was also low, almost tying for lowest volatility overall with the daily averaging frequency.

Honestly, these results were quite surprising to me. I would have suspected that daily contributions would result not only in the least amount of volatility (as it did in this study) but also in the highest return on investment. The reason for this being that I expected with daily averaging that you would capture each incremental price change and purchase the appropriate amount of shares naturally.

You can view the complete details of this analysis by clicking the following Excel spreadsheet link – Optimal Frequency to Apply Dollar Cost Averaging. All historical price data was obtained from Yahoo Finance.

Optimal Asset Class to purchase through dollar cost averaging – using Long Term (LT) Bonds

Having defined the optimal frequency to make contributions through dollar cost averaging (monthly) above, I then set about finding an answer to the question of what the best asset class is to purchase with each new contribution.

To do this, I ran a historical performance back-testing analysis over the 20 year period from 1992-2012 mentioned previously, applying the same assumptions to a $10,000 starting value portfolio with monthly $1000 dollar cost averaging contributions.

The table below shows the performance results for the 4 portfolios I tested – investing each new $1000 contribution in 1) 100% equity, 2) 50% equity/50% fixed income, 3) 100% fixed income, and 4) 60% equity and 40% fixed income securities as specified.

Upon analyzing the table, to my amazement, we see that investing each monthly contribution in 100% long term bonds results in both the most risk/volatility and the highest return on investment of any of the 4 portfolios.

- However, it should be noted that the difference in return on investments in this case between the 4 portfolios is much smaller (only ~1%) than the analysis determining the optimal frequency for dollar cost averaging.

You can view the complete details of this analysis by clicking the following Excel spreadsheet link – Optimal Asset Class Mix to Apply Dollar Cost Averaging. To me, this seemed very counter-intuitive. After all, is the purpose of fixed income securities not to decrease volatility by providing lower returns than stocks due to the risk/return trade-off?In searching for an explanation to this discrepancy, I came up with two reasons:

- During the 20 year period I analyzed, the long term bond fund actually OUTPERFORMED the equity fund (S&P 500) with an overall % increase in price of 419% vs. the S&P500 fund with a 390% price increase.

- While the long term bond market steadily increased (blue line on graph below), the equity market has had significant ups and downs over the past 20 years (see red line on graph below). By investing new money only in long term bonds each month, this required you to make big rebalancing changes each 6 months to maintain your target asset allocation. Thus, while you get to enjoy slightly higher returns by being invested in long term bonds, you also experience an increased volatility from the rebalancing swings.

Optimal Asset Class to purchase through dollar cost averaging – using Short Term (st) Bonds

Seeing the stellar performance of long term bonds during the past 20 years got me thinking – “Would my findings so far that monthly, 100% fixed income contributions result in optimal performance using dollar cost averaging still apply if more conservative fixed income returns were realized?”

In order to answer this question, I then performed exactly the same historical performance analyses to the ones described above, with the exception that instead of using the Vanguard Long-Term Treasury Fund for the fixed income portion of my portfolio, I employed the Vanguard Short-Term Federal Fund (ticker symbol: VSGBX), which exhibited a much more conservative increase in price over the 20 year period in question.

- The results of the frequency analysis once again verified that making dollar cost averaging contributions on a monthly frequency results in both the lowest volatility and highest return on investment. The detailed calculations can be viewed by clicking here.

- On the other hand, the optimal asset class mix analysis including the short term bond fund revealed a somewhat different finding than before. The performance results can be seen on the table below.

As the results indicate, investing 100% of new dollar cost averaging contributions each month in an equity fund results in a slightly (only 0.7%) increased return on investment over the 20 year period. This is more in line with what I would have expected going in to this analysis. The detailed calculations can be viewed by clicking here.

Conclusions and Application to My Personal Finances

Not only is dollar cost averaging a simple technique to implement (just set a certain amount of money each month and forget about it!), but it also makes sense from a mathematical and investing emotions standpoint. Through a historical performance analysis of the last 20 years looking at the most efficient frequency and asset class mixwith which to make contributions using dollar cost averaging, we discovered the following things:

- Monthly contributions yields higher returns on investment than daily, weekly, or bi-weekly contributions.

- Investing the monthly contributions in 100% fixed income securities yields marginally higher returns on investment ONLY if the asset class outperforms equities.

- And, because it is impossible to predict future returns, the differences in returns are very small (only 1% over 20 years!), and equities are more likely to perform better, I think the safest bet is to simply invest 100% of new contributions in equities and then rebalance to your asset allocation targets when appropriate.

Currently, I am personally performing monthly contributions with my retirement accounts, so I’m following the optimal conditions in that regard.

However, when it comes to deciding what type of mutual fund shares to purchase with each monthly contribution, what I have been doing is looking at my current asset allocation each month and buying shares of the asset class I have less of. However, because of these findings, I believe I will alter this habit to buying 100% equity with new contributions.

How about you all? Do you use dollar cost averaging to invest for retirement?

If so, how often do you make contributions? Do the contributions you make go to buy equity or fixed income securities, or both?

Share your experiences by commenting below!

This is a guest article from Jacob blogs at My Personal Finance Journey, where he also runs a monthly 10% income giveaway, with 5% going to blog readers and 5% going to the charity selected by the Grand Prize winner.. Give it a look if you are interested in more in-depth analysis such as this.

I use dollar cost averaging and buy my investments on my paycheck dates so twice a month.

The.only issue I have with this analysis is that it was only done over one time period. Your findings are true for that time period only and really can’t be applied to the future. If you had a supercomputer of the necessary software, I am not sure which, and could run it for every 20 year period for the last 100 years it would be much more reliable although I understand it is not likely possible. Just chaining the start date by 1 day could make a large difference.

Thanks for reading Lance. You make a good point. This isn’t the most perfect analysis since it doesn’t include all dates. However, I’ve found that using a 20 year period is sufficient to smooth out short term trends and give us at least some feel for what’s going on.

Wow…what a great analysis. We teach all of our clients about dollar cost averaging and I encourage people to contribute at least once/month to their Roth; however, I originally believed that every other week was best…but based off of your data it appears I was wrong. 🙂

Thanks for reading Jason. That’s great that you encourage your clients to do dollar cost averaging. What I found from doing this analysis is that merely PARTICIPATING in dollar cost averaging is the key thing. The optimal frequency has a lesser effect (only 10% over the total 20 year period analyzed).

Were re-invested dividends factored in here or was it purely based on price returns?

Thanks for stopping by Dave!

Re-invested dividends were factored in. Let me know if you have any other questions.

Thanks!

Thanks for share this article it’s very helpful to me.

King regards,

Balle Cannon

Hey Jacob, thanks for the article. It has a lot of useful information. I invest once a month close to the 15th of each month. However, I’m always worried and confused if I should choose another day of the month to invest. Do you have any say in this?