Have you been wanting to invest your money but haven’t been sure how to go about it?

Let’s face it, there are lots of choices out there when it comes to investing. Even if you choose a couple of funds to cover everything you need to know which ones and find a brokerage to invest with.

There may be a simpler, easier way to do it for those who those who want to invest but don’t know where to start or think it is too difficult for them.

That answer may be Betterment.

Follow along in our review…

What is Betterment?

Betterment is an easy way for people to start investing in stocks and bonds.

Too many people out there are intimidated with all of the choices they could make — What funds? What stocks? What Indexes? Where? How do I start? What are the fees?– It gets to be that a person is stuck in paralysis analysis and they end up not investing at all!

Betterment makes those choices easier.

They have two baskets of funds you can invest in: Stocks and Bonds.

Pretty simple, huh?

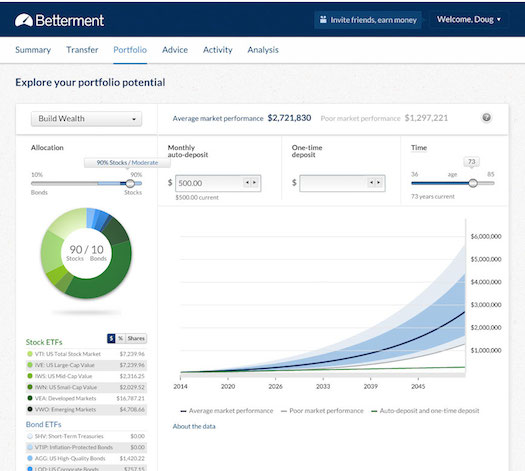

The other big choices are how much to invest and what allocation to pick (how much in stocks versus bonds). The site has tools to help you decide on your allocation and can show you how others in your demographic have invested.

Why Betterment?

Why? Because trying to understand where to invest is too much for you now but you want to invest. Because you aren’t sure what indexes,stocks, and bonds to put your money into and you don’t want to see a broker.

If that’s you then look into Betterment.

Where is Your Money Going In Betterment?

There are only two investment baskets – Stocks and Bonds. These are made up of ETF’s that have been picked by Betterment to give you a broad exposure to stocks and Treasury bonds (that’s called Diversification) while keeping fees low.

You give Betterment your investing goals and they will suggest allocations for their investments based on your goals and rick tolerance (that’s Allocation). This keeps your choices limited while still giving you room to fine-tune your allocations.

Put simply – you tell them what you expect and they tell you where to put the money.

Here are the stocks Betterment invests in:

- Vanguard Total Stock Market (VTI)

- iShares S&P 500 Value Index (IVE)

- iShares Russell Midcap Value Index ETF (IWS)

- iShares Russell 2000 Value Index (IWN)

- Vanguard FTSE Developed Market Index ETF (VEA)

- Vanguard FTSE Emerging Markets Index ETF (VWO)

Here are the bonds Betterment invests in:

- iShares Short-Term Treasury Bond Index ETF (SHV)

- Vanguard Short-term Inflation-Protected Treasury Bond Index ETF (VTIP)

- iShares US Total Bond Market Index ETF (AGG)

- iShares Corporate Bond Index ETF (LQD)

- Vanguard Total International Bond Index ETF (BNDX)

- Vanguard Emerging Markets Government Bond Index ETF (VWOB)

If you want to see what makes up each ETF either look up the ticker symbol or go to the Betterment site where you can download the prospectuses of the ETF’s.

What you are invested in is pretty transparent.

Wait, If They Are Telling Me the Funds Why Don’t I Do It Myself?

That’s a pretty good question!

Go right ahead. You can find those funds through most online brokerages. But you will have to invest individually in each of the ETF’s and pay commission fees for each transaction (and pay that commission every time you add more money). And you will pay commissions if you want to change your allocation.

With Betterment there are no commission fees.

Oh, and you will have to allocate those funds yourself and keep track of it yourself. Yup, you are going to have to re-allocate on your own as the percentages change with market fluctuations. And you’ll have to go through each fund and adjust them to your level of risk.

Is it impossible to do?

Not at all. But I think the other point here is that if you are a person who is willing to invest in all of these funds yourself then you might not need the “set it and forget it” ease of Betterment.

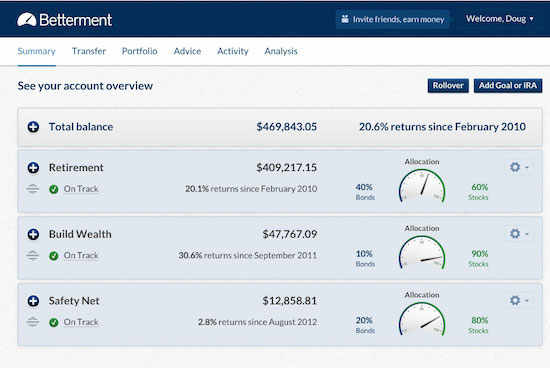

You Tell Them Your Goals

We all have different goals for our money, don’t we? Well you can set up different goals in Betterment. You can set up goals to buy a house, save for college, retirement… it’s up to you. Betterment will adjust its investing advice depending on your goal.

About their advice — for each of your goals you will get guidance on what allocations to pick how much to fund your account. Set up one-time investments, automatic investments, or add as you can — it’s your pick.

Sounds Great But What Does Betterment Cost?

They have to get paid something, right?

And they do. They get paid a management fee based on your balance. This fee can range from 0.15% to 0.35% and is charged every quarter (every three months so that fee is cut in four over a full year, i.e. 0.0375% to 0.0875% of your average balance each quarter).

They break their fees into three tiers:

- Builder – up to $9,999 and the management fee is 0.35%

- Better – from $10,000 up to $99,999 and the management fee lowers to 0.25%

- Best – $100,000+ and your management fee is 0.15%

And right now you can try an account for the first 30 days free.

You also get fee free bonus months added depending on how much you open your account with. Here are the tiers:

$1-$4,999: One month free

$5,000-$24,999: Three months free

$25,000-$99,999: Four months free

$100,000+: Six months free

A note about accounts under $10,000 — you need to have an automatic deposit of at least $100/month for the 0.35% management fee, otherwise you pay $3/month. That’s a pretty strong incentive to either get to that $10k threshold or set up a $100 a month transfer. Still, the potential $36/year in fees can end up less than what you might pay in commissions and fees at other brokers if you wanted the same fund choices and allocations. It’s food for thought if you are opening an account under $10k and don’t plan on adding $100/month in auto-deposits.

Their management fee covers all trading fees (no commissions every time you add more in your account), rebalancing, allocation advice, and everything else Betterment needs to keep things running.

Compare that with your average online broker where you pay a commission every time you buy or sell a fund. There are some brokers that have free-trade funds but you may have to have a minimum balance in order to get in.

Oh, you are free to add or remove funds without any fees. Try doing this at other brokerages. You’ll have to sell your securities first and pay the commissions on those and then close your account.

Here Are Some Other Features of Betterment:

A fast signup of only five minutes.

After entering things like your contact information, your birth date, social security number, employment information, and your checking account information (they use your existing checking account for easy transfers and management of your money), you will be able to start investing in their portfolios of stocks and bonds.

No minimum balance.

You do not have to keep a minimum balance like you do in many investment accounts. You are free to move your money around when and how you choose among their funds. There’s also no minimum investment.

Great customer service.

Help is always available to you by phone or email if you have any questions or concerns.

The ease of having your account linked to your checking account.

Your checking account will be electronically linked to your Betterment account. You can transfer money back and forth any time you like with no fees. If something comes up where you need your money, it can be back in your checking account in 2 to 4 business days.

Want to see your Betterment account on the go? Betterment has iPhone and Android apps for that.

You can rollover your retirement account.

You have the option to rollover retirement accounts like IRA’s, 401(k)’s, and 403(b)’s.

They automatically rebalance your account and reinvest your dividends.

As the markets change, your portfolio of investments will as well. Betterment rebalances your account back to where you desire quarterly, or if the portfolio composition goes below 5%.

Rebalancing your portfolio on a regular basis is recommended, as it can increase returns and decrease risks. Generally, most investors don’t even do this because of all the work involved with it, so with Betterment doing this automatically for you can make managing your investments even easier.

You also get the benefit of investing in fractional shares. Every bit of your money will be invested.

Safe and Secure.

Betterment values your trust and therefore does not sell any of your information to a third party without your permission. They also use banking industry standards to protect your account. All your funds are SIPC protected against any fraud or mismanagement (up to $500,000).

With Betterment, you are investing in thousands of companies all at once due to their diverse stock portfolios of ETF’s.

Their portfolio consists of stocks that reflect the broad U.S. market. Since stocks are a risk with generally a higher long term return it is wise to have a diverse portfolio. While bonds generally have a lower return, they also have a lower risk.

As with all investments though, there is always a risk, as is the case with Betterment’s investments as well.

As the only investments you can make with them are in stocks and bonds (in their choice of ETF’s), you have limited investment options and are at a risk of losing money due to market fluctuation. When markets are up your investments will go up as well, but when markets are down you can expect to see your investments go down.

At the same time, your money will be invested in broad indexes so you won’t have the risk of individual stocks or bonds not doing well. You will follow the market returns to a degree.

Final Thoughts on Betterment

I think Betterment is a great idea.

So many people want to invest but they really get overwhelmed with all of the choices. With Betterment you get guided choices that invest in broad stocks and Treasury bonds. You also get the benefits of easy allocation, re-balancing, re-investment of dividends, and fractional shares. And it’s as easy as opening an online bank account.

So if you want to start investing and want a real simple way to do it, take a look into Betterment and see if you like it and it’s a good option for you.

Open a Betterment account now.

Thanks for passing along this information. Definitely need to check it out.

You’re welcome Jenna. Let me know what you think!

Hum, sounds like an interesting concept, although I am with Jon, paying higher fees is definitely a bad thing. Still, as a way of easing some of my more apprehensive family members into investing, it might be worth a closer look.

Well, I think that’s where Betterment is strong. You get those people who want to get their feet wet but wouldn’t otherwise actually invested in the market. It’s not for someone more sophisticated that will figure out where they want to allocate.

Very true; as I noted, for those members of my family who aren’t nearly as interested in personal finance as I am, it could serve as a good way to get their feet wet. I do like to see companies who try to simplify the investing process; growing your money is something that should be as simple as possible.

Is this for people with money left over from maxing out their 401Ks and IRAs and stuff? I guess I just buy an ETF(s) or a target dated retirement mutual fund and have things pretty simple.

No, to me Betterment is for people who want an easy way to invest and they aren’t sure where to start.

I know you’re way more investing-savvy than the average person Sam. But remember, there are a LOT of people out there who don’t invest because they don’t know where to start.

What about just buying one of those all-in-one target date retirement funds that does everything for you?

Hi Financial Samurai, Jon Stein here, Founder and CEO of Betterment. We’re focused on making investing easy and accessible, and so I think the target date funds were a great innovation – they’re directionally correct and help a lot of investors. But they fall short for some people.

First, target date funds aren’t customized for your personal risk tolerance – they’re one-size fits all. Betterment acknowledges that people have different needs – some of us freak out when one-year losses occur – and that could keep people from investing for retirement at all. So we take risk tolerance into account in setting our retirement glide-path.

Also, not all of your investments are for retirement. What about your shorter-term savings? Betterment lets you pick the right savings goal and horizon for you (and coming soon, multiple goals, if you want).

What if your needs change and you decide that you’re going to buy a house in 2 years and need your savings for that? Betterment is flexible and fee free to make adjustments like this.

With a target date fund all your assets are with a single company – you’re captive. Betterment hand-picks the best ETFs from across all fund companies.

Betterment is also easier and more accessible than any target date fund I’ve seen. That is, there’s no minimum, it’s takes about 10 seconds to initiate a deposit or withdrawal, and it takes less than five minutes to setup.

These are just some top-of-mind thoughts. I’m not knocking target date funds – they’re a great tool – they’re just not for everyone.

Jon.

Thanks for stopping by to comment Jon!

I think the really cool thing about betterment is the no account minimum. There’s a lot of people like me out there that are still young and simply don’t have enough money to open a Vanguard account with a $3000 minimum per fund. I would need over 10,000 to build a diversified portfolio which I hope to build towards but simply can’t afford right now. Even with betterments .9% fee I’m obviously still seeing my investment money grow a lot faster than the money market account I use for my emergency fund with its .75% apr. I do wish betterment had some international allocation but overall beating inflation while I build my investment money is a lot better than watching it collect dust.

And that there is a great reason why Betterment is awesome for a new investor. It’s tough to pool together 3k to put into one fund. For the new investor that ay very be a lot of eggs in one basket. Here you can put smaller amounts in to start and build up as you go along. I know when I first got out of credit card debt, $3000 was an awful lot of money, especially coming from a point of living paycheck-to-paycheck.

Great post. I think Betterment is a tool worth consideration for SOME investors. I think the fee for a basket of ETFs without any further advice (if I correctly understand their model) is a bit high. At that point I think many people would be better off engaging the services of a financial advisor even if only on an hourly as needed basis. While this may sound self-serving coming from a financial advisor, people should take into account what type of help, if any they really need and get it. Investing for one’s future is not a task to be taken lightly and should be done as part of an overall financial plan.

The Betterment folks have seen fit to blast financial advisors in a recent post. My take is that Betterment (and similar services) are a good addition to the options for investors, there is room for all types of advice and investing services. One note on the article I referenced which is on the Betterment site, they incorrectly lump financial advisors and stock brokers together and I feel mislead the reader.

You make good points Roger but consider the average person who’s not knowledgable about investing. What are the odds that they will seek out a credible financial advisor? A site like Betterment helps them get started investing without too much else.

Glen I agree that Betterment and similar sites are useful and have a place among the choices that investors might consider. As far as seeking out a credible advisor at least via NAPFA (a professional organization of fee-only advisors who range from hourly to high net wortth clients and of which I’m a member) the advisors with whom I converse have seen a jump in inquires from investors seeking help. While I like much about Betterment, I am leery of investing without some sort of financial plan in place, clearly my professional bias and experience talking here.

Johanna from Betterment here.

Roger –

We updated the post on our blog to make the distinction between RIAs and advisors who receive a commission payment for the financial products that they broker. In the article we were calling out those who profit from giving bad advice (not cool). We respect and appreciate the work of good investment advisors.

Speaking of fees –

Cost is incredibly important in investing. High fees will only eat up returns. It’s why we think it’s important to charge a low AUM fee – 0.15%-0.35% – and nothing additional.

Thanks, Johanna

Impressive thread of comments here, especially since the CEO of Betterment chimed in. I’m not a user of betterment (because I feel comfortable handling my own investments) but I love the family of mutual funds they invest in. The Vanguard total stock market index fund is one that is in all of our retirement accounts. If you are looking for a hands off way to do your investing betterment is a great option. Personally I just do everything myself.

Betterment is a very interesting concept and seems to be geared towards people who are more on the novice side of investing. The thing I don’t like is the portfolio overlap. Once you have the total stock market index you have basically the entire US investable market. Obviously Betterment is tilted towards the value side of the equation which is also more on the riskier side. Typically the average person is not going to have 12 different funds that they are investing in but Betterment does make that easier.

And a thought on target date funds. If people are picking target date funds because of their projected date of retirement instead of their asset allocation, then they are doing it all wrong. You can easily pick a target date fund that has assets allocated closer to what you want. For instance the Vanguard Retirement fund is a 30% stock, 70% bond fund with 5 different Vanguard funds in it (Total Stock, Total international, Total bond, ST tips, and total international bonds) all for .17% expense ratio.