tradeMONSTER is a real time investment trading platform that features some of the lowest trading fees in the industry.

Though it has only been around a few years, it has grown steadily in to one of the most popular trading platforms for active, self-directed investors. If this describes you then read on see if tradeMONSTER is for you!

Who Is tradeMONSTER?

tradeMONSTER was co-founded by Jon and Pete Najarian and Dirk Mueller-Ingrand. All are professional traders and respected investment industry experts. When founded, the company was a subsidiary of tradeMONSTER Group Inc.

The founders initially created optionMONSTER.com, a provider of financial market intelligence and analytical commentary. The site was created in 2006 to help make their investment approach available to the general investing public, in an attempt to close the gap between self-directed investors and institutional investing.

tradeMONSTER began operations in 2008 as a real-time trading platform, and immediately won a four star rating from Barron’s.

The platform has continued to grow and to earn industry accolades since. In fact, last March, Barron’s named tradeMONSTER “Best For Options Traders” in its Best for Online Brokers of 2014 survey for the fifth consecutive year.

In May of 2014, the company announced a merger with OptionsHouse, a subsidiary of PEAK6 Investments. Under the agreement, both companies will be acquired by General Atlantic, who will be the majority shareholder in the combined company. The combination was completed in early September, but the two companies will continue to operate as separate entities for the time being.

tradeMONSTER Fees and Account Minimums

It’s never recommended that you discuss price early in a discussion (or is that just for job interviews???), but price is a major tradeMONSTER advantage.

That makes it the perfect starting point for this review.

Pricing is among the best in the industry, and often THE best, which is part of the reason for tradeMONSTER’s success in such a short amount of time.

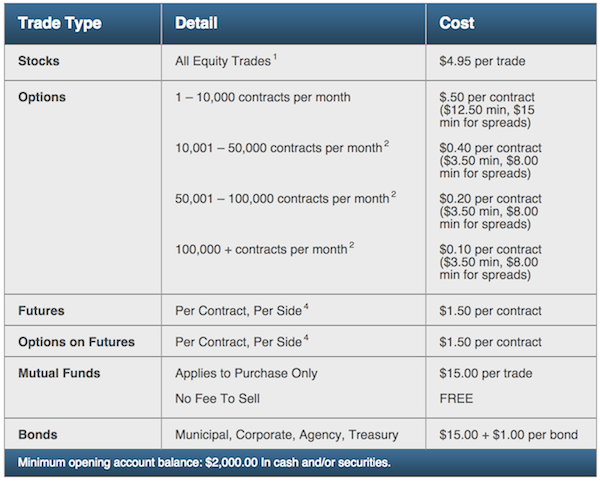

tradeMONSTER’s current fee structure is:

- Stock trades: $4.95

- Mutual funds: $15.00 (purchases only – no fee to sell)

- Bonds (municipal, corporate, agency, treasury): $15.00 + $1.00 per bond

- Futures, per contract, per side: $1.50 per contract

For options trading, the fee structure looks like this:

- 1 – 10,000 contracts per month: $.50 per contract ($12.50 min, $15 min for spreads)

- 10,001 – 50,000 contracts per month: $0.40 per contract ($3.50 min, $8.00 min for spreads)

- 50,001 – 100,000 contracts per month: $0.20 per contract ($3.50 min, $8.00 min for spreads)

- Over 100,000 contracts per month: $0.10 per contract ($3.50 min, $8.00 min for spreads)

- Options on Futures, per contract, per side: $1.50 per contract

Account Minimum: An account with tradeMONSTER requires a minimum deposit of $2,000.

Click here to start your tradeMONSTER account.

How tradeMONSTER Works

The platform accommodates both individual and joint accounts, as well as trust and custodial accounts. You can also have a traditional, Roth or roll-over IRA, all with no annual custodial fee (trading fees do apply). There are also accounts available for corporations, partnerships, LLCs and investment clubs.

Some of the tools tradeMONSTER offers include:

- Trading Screen Customization. tradeMONSTER will allow you to customize your trading screen to just about any way you want it to look and function. You can do this simply by dragging and dropping your preferred tools and screens into your trading screen to fit your preferences.

- Professional Grade Trading Tools. This includes streaming quotes, charts, option chains, professional grade scanner, strategic exit planning tools, advanced performance tracking tools, robust technical analysis tools, and everything you need to be a successful trader.

- spreadMAKER Tool. This tool enables you to build spreads quickly and easily. It allows you to build and edit different spreads using drop-down boxes, expiration dates and strike prices, keeping critical information in one place for faster trading.

- Analyze Trading Strategies. You can analyze your risk/reward and see your option strategy profits and losses between now and the expiration for any path the underlying security may take before you place your trade.

- Platform and Investing Education. tradeMONSTER’s education resources are among the very best available on the web. There is a wealth of resources available on trading stocks, options and futures. There are also resources to help you maximize your trading experience on the platform, as well as a platform blog.

- Autotrade. This feature allows you to trade stock and option recommendations from a long list of newsletters.

- paperTRADE. This is tradeMONSTER’s virtual trading tool that allows you to use all of the tools and features of the entire platform without risking real money. When you’re comfortable trading virtual money, you can switch over to the real thing.

- tradeCYCLE. This might be the most interesting tool on the tradeMONSTER platform. It provides you with a step-by-step investment process that you can use in your trading activity, that will spell out everything you need to do on every trade, from researching your investment picks to determining when to sell a position. tradeMONSTER may very well be worth using for this feature alone.

- tradeMONSTER Mobile. All the comforts of tradeMONSTER are available on your iPad, iPhone, Android or Android Tablet.

What You Might Not Like About tradeMONSTER

In the interest of full disclosure – and just so that you understand that there are no totally perfect trading platforms out there – tradeMONSTER comes with it’s own set of limitations:

Margin trading.

We’re not advocating for margin trading here, but some investors are perfectly OK with it. TradeMONSTER’s requirements to have a margin account are stiff. The platform requires a minimum account balance of $300,000 before you can even apply for margin account approval. For smaller investors who like to use margin trading, this will definitely be a problem.

Customer service.

tradeMONSTER’s customer service is reported to be excellent – but it’s limited to Monday through Friday, from 7:30 AM to 5:00 PM Central Time. And that’s by phone, email, fax or live help. If you’re accustomed to 24/7 support, this could be an issue.

Higher fees for extended hours trading.

tradeMONSTER charges an additional 1 ½ cents per share for extended hours trading. If you’re trading 100 shares, that will add $1.50 to your $4.95 base trading fee – still an outstanding deal by industry standards. But if you’re trading 1,000 shares, it will add $15.00 to the basic trading fee, bringing the total to $19.95. That makes tradeMONSTER less competitive on the transaction cost front.

It’s clear that the folks at tradeMONSTER have a deep fondness for regular business hours.

Will tradeMONSTER Work For You?

If you are a small investor, the $2,000 account minimum balance could be a stumbling block (though it will certainly give you something to aim for!). There’s also an obvious limitation if you are a margin trader with less than $300,000 to invest, as tradeMONSTER will not allow you a margin account. And trading during extended hours could be a problem on the transaction fee front.

Apart from those situations however, tradeMONSTER is virtually the perfect platform for active, self-directed investors, particularly those who are heavy traders. The combination of low fees (as long as you don’t plan to trade after hours), trading tools and information/education are a trader’s dream.

tradeMONSTER Promotions

There are a couple of promotions running at tradeMONSTER that you should know about.

First, when you open up an account you can trade commission free for the first 60 days. Second, when you transfer an account to tradeMONSTER they will reimburse you up to $250 for the cost of the transfer

Click here to start your tradeMONSTER account.

You can use automated forex scalping and allow the system to automate the stop-loss and take-profit and you will handle the calculations and analysis.

For instance if you have bought yourself concert tickets

for a concert you want to go and see, only to find that you can’t go for whatever reason, then this is a frustrating and upsetting thing to happen for

many reasons. So choose a broker who has fast execution of orders so that

he can trade more orders in just one second.