I hear a lot of people interchanging the term credit report with credit score.

I do it myself.

But there’s a Big Difference between the two. See how I bolded that there? That’s how important it is.

Knowing the details of a credit report vs a credit score will help you better understand your credit. And that can help you save money!

Differences Between a Credit Report and a Credit Score

Credit Report

Your credit report is really a snapshot of your credit use history. It shows potential lenders:

- your personal information (name, address, social security number,

- what kinds of credit you use (credit cards, mortgages, loans)

- how long the credit line has been open

- whether you have paid your bills on time (including any collection information if a debt had to be passed on to a collection agency)

- how much of the credit you have used and what is outstanding

- whether you have been looking to open new sources of credit (any credit inquiries that have been made)

- banking information

- public records (such as bankruptcy or a court-related judgment).

Lenders, such as credit card agencies, look at your report to determine if they should extend you credit (like a credit card).

Basically, your credit report gives a lender a view of whether you pay your debts back or not.

By law, everyone is allowed free access once every 12 months to their credit report from each of the three national credit reporting agencies (Equifax, Experian, and TransUnion). You can order a free credit report check from AnnualCreditReport.com. (Watch out for other companies that say they can give you a free credit report but they are really trying to sign you up for a service or get you to buy something else.)

You should check your credit report yearly to make sure all of the reported information is correct and that there are no fraudulent accounts that have been open in your name.

Though lenders use your report to determine if they should extend credit to you, the report won’t tell you what you can expect as an interest rate from the lender. That leads us to…

Credit Score

Credit scores use the data in your credit report and assign a number (usually ranging from 300-900) which shows lenders how much of a risk you are in paying back a debt.

The higher your score the less of a risk you are (that’s why a high score is important in getting a good finance rate).

The most common score used is the FICO score calculated by Fair Isaac Corporation. There is one FICO score for each of the three reporting agencies. The agencies may also have their own version of a credit score but FICO is the most widely used.

You can get your official FICO score at myFICO. See my experience using myFICO.

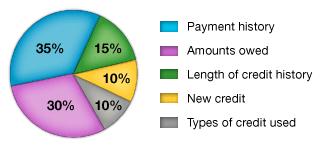

Here is a breakdown of how your credit score is calculated:

Your credit score could be used for credit card applications, auto loans, mortgages, insurance, and by potential employers.

Insurance and employers? Yup.

Insurers treat a high score as being more responsible and can get you better rates (if you have a good score make sure to mention it to your auto insurer). Employers use the score in the same way. They look at your score as a measure of how responsible you may be with your work. It may not be fair

You should check your credit score if you plan to make a big purchase that would require financing such as buying a car or a house. Try out this calculator from myFICO to see how different scores will affect your financing.

Monitoring your credit score is also a great way to make sure there us nothing happening on your account that could potentially hurt your credit score. Checking your credit score allows you to see what areas may need improvement. You never know when you might need credit.

There are a number places that will monitor your score and give you a credit score for free. Some are completely free while others offer free trials.

See where you can possibly get your credit score free.

To Recap Credit Report Versus Credit Score:

Credit Report – shows credit history. It gives a list of the accounts you have open and how you have paid over time. Check it yearly to make sure the information is correct.

Credit Score – a number that indicates your credit risk; what a lender will use to determine your interest rate on your financing. Check it to gauge what kind of financing you can expect from a lender.

Remember, knowing a credit report vs a credit score can help you protect your credit AND save you money.

So, would it be correct to say that a credit score is included in a credit report? Thanks for clarifying.

No, that wouldn’t be correct. Credit reports and credit scores are separate.

There may be products out there that package them together though but don’t make that assumption until you read the details.