It doesn’t seem like much.

A 2% management fee for a managed fund. A $9.95 transaction fee when you make a stock trade.

There is no getting around fees in the investing world.

You’re going to pay them at some point. However, you can reduce what you pay in fees — and you should. You might be surprised to discover how much money you are wasting, and the long-term impact it can have on your real investment returns.

Why You Absolutely Must Pay Attention to Investing Fees

Piling on the Fees

At first glance, your fees probably don’t seem like a big deal. However, once you start looking at the way they pile on, the story changes.

However, once you start looking at the way they pile on, the story changes.

Take a $9.95 transaction fee. If you have a monthly investment plan that allows you take advantage of dollar-cost averaging, you will have an automatic trade performed every single month. That $9.95 will reduce the number of shares you can buy, cutting into your overall return, to the tune of $119.40 per year. If you continue this trend for 30 years, you will pay $3,582 in fees, just to trade.

Even if your broker offers a discount for signing up for an automatic investment plan by cutting your transaction fee to $7.95 a trade, you’re still paying $2,862 in fees over 30 years.

Other fees can add up even faster.

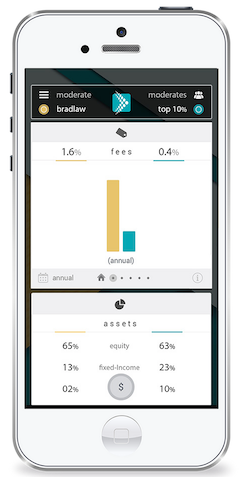

Want an easy way to see the fees you’re paying? Draft gives you a quick look and analysis of the fees in your investing accounts so you can make informed decisions about your portfolio. Easily see how much you’ll expect to pay in fees. You have the power to pay less and Draft is the instrument to help you do it. Draft recently demoed their product at the industry leading conference Finovate. Draft’s private beta is open; click over there and make sure you’re not paying too much in fees!

Want an easy way to see the fees you’re paying? Draft gives you a quick look and analysis of the fees in your investing accounts so you can make informed decisions about your portfolio. Easily see how much you’ll expect to pay in fees. You have the power to pay less and Draft is the instrument to help you do it. Draft recently demoed their product at the industry leading conference Finovate. Draft’s private beta is open; click over there and make sure you’re not paying too much in fees!These fees are mostly management fees. If you have a retirement plan through your employer, you could be paying administrative fees amounting to anywhere between 1% and 3% of your account’s value. On top of that, there might also be fund fees associated with your investment picks. If you choose actively managed funds for your retirement account, you could end up with up to 2% annually fees.

It’s easy to see how these fees can get out of hand quickly. A 2% fee on an account worth $200,000 is $4,000 for a single year. And, of course, as your account grows in value, the fees grow as well.

When you consider various retirement accounts and add up the fees you are paying for all of them, you might be surprised at how much you are losing to fees.

Fees and Opportunity Cost

The real killer for your returns, though, has to do with opportunity cost. You’re not just paying a few thousand dollars in fees over the life of your investments. Remember that each time you pay a fee, that’s money that could have been invested and earning a return.

Think tank Demos published the results of a study in 2012 indicating that a median-income, two-earner household will pay close to $155,000 in 401(k) fees over the course of a lifetime.

At first glance, this might seem like a ridiculous number — especially since it only takes into account 401(k) plans.

However, the reality is that fees do matter, and the nature of compounding interest means that fees matter even more over time. The more you pay in fees, rather than investing the money and earning a return, the more you are missing out on.

Here’s An Example to Convince You

Let’s say you have an account worth $100,000 in an IRA and you’ve been investing in actively managed funds, and paying a fee of 1.5%. Your annual cost would be $1,500. But what if you decided to invest in an index product with an expense ratio of 0.25%. Your annual fee, in this case, is $250. That’s a savings of $1,250 for the year. If you invest that money each year and let it grow for 30 years, assuming a 7% annualized return, you’d end up with $135,856.62.

Rather than paying an extra $37,500 in fees over the next 30 years, you’d actually make almost $136,000 extra. And that’s not even the true potential since your savings would adjust each year as your account value increased. Plus, when you stop to consider that there are index ETFs out there with expense ratios as low as 0.04%, the opportunity cost of paying fees in actively managed funds is even greater — especially when it appears that index funds are a better deal for most consumers.

Final Word On Why You Must Pay Attention to Investing Fees

Fees matter and they matter a lot. Your wealth could be impacted by hundreds of thousands of dollars if you don’t pay attention to fees and work to actively reduce them.

Pay attention to what you are paying, and try to reduce your fees. You’ll always pay them, but you shouldn’t need to pay so much.

This post is part of the #IwantDRAFT campaign with support from DRAFT, the app that uses crowdsourced data to help you understand and compare your portfolio, in partnership with Kasai Media.

Have you signed up for Draft Yet? Draft does more than fees. They are also a simple one-stop dashboard where you can see all of your investment accounts in one place. They give you a complete financial portrait so you can see your allocations over your entire investment portfolio.

Draft also uses crowd-sourced data so you can compare your returns, allocations, and fees against other people.

Excellent article. Unfortunately the impact of these seemingly “small” fees doesn’t seem to get through to nearly enough people. It really hit me a few years back when I had in an investment account with a sizable portion of the funds in the money market. The 1.5% fee worked out to be 30% of the return!! A painful lesson.

Nice article. You repeated this line: “However, once you start looking at the way they pile on, the story changes.” Just a heads up.

Also, you may want to give eOptions a try for your stock trading. They’re about half the cost of any other stock broker. I use them for stocks and options trading.

Investing fees can sometimes be too much, so you need proper research before embarking.