I had never heard of Motif Investing when Glen asked me to take a look at them and write up a Motif Investing review. Having done so I’m really glad I’ve been made aware of this investment firm.

This is one of the most unique value propositions I’ve heard of for retail investors in quite some time. If you ever plan to invest for your future retirement I think looking at Motif is a good idea.

What is Motif Investing?

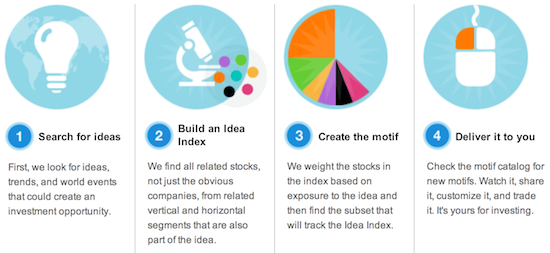

Motif Investing is a brokerage firm that gives investors the ability to invest in a basket of stocks surrounding a specific idea with just one trade.

It’s an interesting twist on investing that I’ve not seen before. Sure, you could individually buy a basket of stocks around an idea, but that would be expensive and require a lot of research.

Investing in a motif is different.

The “motif” is the idea that you’re interested in. Let’s say you think cloud computing is going to be a great investment in the coming years. That’s great, but which stocks do you invest your limited cash into? The major companies? A group of smaller players? It can be hard if not impossible to know how these companies are going to shake out with a new industry phenomena kicks in. To solve this problem you pay one trade fee to invest your money into a motif of stocks that are focused just on cloud computing.

“Wait, that sounds an awful lot like an ETF. What’s the difference?”, you might be thinking.

It is somewhat similar to an ETF, but there are some critical differences:

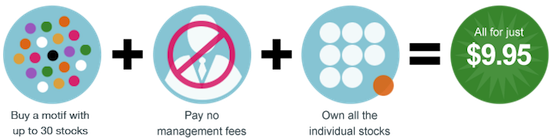

- With an ETF you are trading shares of the ETF. With a motif you are actually purchasing shares of the companies within the motif rather than in the ETF.

- With an ETF the investment professionals at the ETF company decide which companies are included in the fund. With a motif you can change the holdings within the motif before investing your money.

- With an ETF you will first pay a trade commission and then an annual expense ratio. With motifs you are buying shares of companies, not in shares of the ETF, thus you pay no expense ratio fees.

It’s a really interesting idea because instead of spending $210 to buy shares in 30 companies (at about $7 per trade with an online brokerage company like TD Ameritrade) you can invest the same money into the same basket of companies for one trade fee of $9.95.

That’s unbelievable! That’s a lot of extra money saved in trade fees that you can use to actually invest further.

What is Motif Investing’s Fee Structure?

It is always good to know how the brokerage firm you are investing your money with is going to actually make money.

Having a low cost firm is great, but anyone that promises to do the same work for free should be looked at questionably. Companies need to be profitable to stay in business.

So here’s how Motif Investing makes money:

- $9.95 per trade to buy or sell a motif of stocks

- $4.95 per trade to buy or sell individual stocks (or ETFs) within one of your motifs

- Account closure fee: $30 to wire funds out of your account (plus some other normal account fees you’ll see at every discount brokerage firm)

That’s it.

There’s no $50 membership fee or a surprise $20 fee for using the website. Very simple cost structure that is easy to understand. (To see the full fee schedule you have to go to their Cost Efficient Investing page then click on “For more information, please refer to the Motif Investing pricing details.”)

What’s the Catch of Using Motifs to Invest?

This sounds too good to be true. There has to be a catch, right?

There are two minor catches in my eyes.

Minimum Investment Amount

You must invest $250 or more each time you want to buy a motif. It’s kind of like an account minimum, but it is only on the money you’re transferring in to complete the investment. And truthfully, you shouldn’t be investing small amounts of cash in individual stocks anyways. You want to put as much money as possible on each trade to minimize trading costs. (For example, you’d rather invest $1,000 once for a $9.95 trade fee than investing $250 four different times for $39.80 in trade fees.)

Don’t Make One Motif Your Entire Portfolio

The only other catch I can see would be to buy into the idea that one motif will cover all of your diversification and investment needs.

While you can buy up to 30 stocks in a single motif, that alone won’t be enough diversification for you. (Remember, your motifs are a basket of similar stocks so you’re missing diversification even though you’re getting many stocks in one shot.) I would add motifs as an add-on to my portfolio rather than the main event. You are better off from a diversification standpoint by investing in an S&P 500 index fund which obviously holds shares of 500 different companies rather than 30 similar firms.

Final Thoughts

Whether you are looking to open a Roth IRA or just a taxable investing account, Motif Investing seems like a great place to get started. The trading costs are incredibly low in comparison to other discount brokerage firms just because of the large number of companies you can invest in with just one trade commission paid to the company. If you’re looking to invest in different sectors or trends, investing in a specific motif can be a great move forward in that goal.

Click here to open a Motif Investing account or to learn more.

I don’t really understand the company. How am I able to buy a piece of 30 companies for $9.95? It almost seems like they are taking a major loss, for what? To sell the idea to another investment company one day? I don’t really get it.

Ignoring not understanding the business, it seems like a really cool way to invest.

First off…I love the idea, but ultimately the $30 xfer fund to withdraw is a deal breaker for me, I know why you do it, I use scottrade and they make it hard to cash out money too (not that hard), but its not just about the dollars and cents, it is the symbolism and structure, I just cant assume a brokerage firm has my best interest in mind with its highest fee set to move funds out, I would much rather pay a membership or set up fee, at least i get to feel like i get something for that other than access to my own money. Good Luck

Mike