Whether you're looking to do some cleaning, looking to go green or paperless, or just want to get a little more organized, Shoeboxed.com can help you. Imagine this... You're getting ready to finally do your taxes. Besides all the tax forms you need you also have to put together your receipts. But where are they? If you're like most people they are piled up someplace, like a shoebox, … [Read More...] about Shoeboxed Review – Organize Your Receipts for Tax Time and More

Main Content

Featured

All About Taxes

Tools to Help Organize Your Taxes

When you’re down to the wire at tax time, organization is your best friend. Your best option is to stay organized year round so that you aren’t scrambling at tax time. There’s not much worse than trying to find a tax document right before you file your taxes or head to the accountant. Whether you are […]

How to Spend Your Income Tax Refund – 25 Ideas

Are you getting a big IRS income tax refund? It’s always nice to get a nice chunk of change coming back to you, isn’t it? But what will you be doing with your income tax refund? I’m not always fond of looking forward to a large refund but they do happen and I know some […]

Where’s My Tax Refund? How to Check the Status of Your Tax Refund

When you are expecting a tax refund, it is normal to file a little bit early. The very next thing you say once you file is “where’s my refund?” We can’t wait to get that money owed to us. Indeed, many people have already received their tax refunds. When you get your tax refund depends […]

Personal Finance

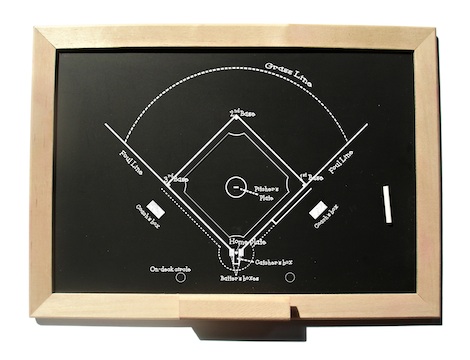

Five Ways Fantasy Baseball is Like Personal Finance

I had my draft for my fantasy baseball league I’m in last week. I’ve been in the league with these particular guys now for over ten years. It’s not a money league, but we’re real competitive nonetheless (we’ve been playing against each other for over a decade now). I gotta say I’m stoked! Real baseball […]

Your Guide to Setting SMART Goals For Your Finances and Life

It’s that time of the year where people start fresh and make new goals, and many of those are financial. But are they smart goals? Did you know that according to a 2007 survey by British psychologist Richard Wiseman, 88% of resolutions end in failure? We tend to try to do too much with little willpower to […]

More on Free From Broke

Money Market Account VS Savings Account – What’s the Difference?

There are many different savings vehicles to choose from, but two of the most common are money market accounts and savings accounts. There are similarities between the two—both pay interest, have fixed balances, and are pretty easy to deposit money into or withdraw it out. Either account type could accomplish your savings goals. But there […]

Don’t Let Your Goals Fizzle Out! – 5 Reasons Goals Fail, and What You Can Do To Make Yours Succeed

It’s become a yearly ritual for many: Set ambitious goals for the New Year, tackle them enthusiastically for a few weeks, and then give up on them completely by March. This is a vicious cycle that encourages you to feel bad about yourself, and feel as though you’ll never get out of your rut. Whether […]

What Do You Think of New Year’s Resolutions?

This is the time of year where you come up with a list of resolutions for the New Year. Some want to exercise more. Others simply want to lose weight. Some want to save more money, while others want to get out of debt. What do you think of New Year’s resolutions? I’m not sure […]

What Are Your Kids Gift Expectations?

I hear people complain that they have to buy expensive things for their kids because it’s what they (the kids) expect. Some don’t know what they are going to do this holiday season as times might be tight for them. How are we going to get little Johnny the latest (insert expensive popular toy here)?!? […]

Thank the Troops This Holiday Season By Giving Back to Them

There is probably no other holiday season that evokes a desire to be home, surrounded by family and friends more than the end-of-the-year holidays. Many American soldiers who are stationed far away, can only dream about going home. Not only do they experience a sense of longing for family and friends, but they also miss […]

Your Guide – Tips for Holiday Tipping (and My Story Working for Tips)

TiThis week, I’m reviewing all of the people who provide me with services, and figuring out how much to tip them. The following are my tips for holiday tipping. It’s appropriate to tip service providers that you see on a regular basis at holiday time. And avoiding services in December in order to weasel out […]