You know that making purchases using credit cards is expensive if you do not pay off your balance each month. Indeed, carrying a balance on your credit card is one of the biggest ways that people waste money each month. However, it is hard to see this, since the minimum payments required by credit card companies are so small and seem so affordable. The Credit CARD Act of 2009 has required credit card companies to list total payoff amounts, and alternatives to only paying the minimum, on statements, but many still overlook some of the issues associated with a slow repayment of credit card debt.

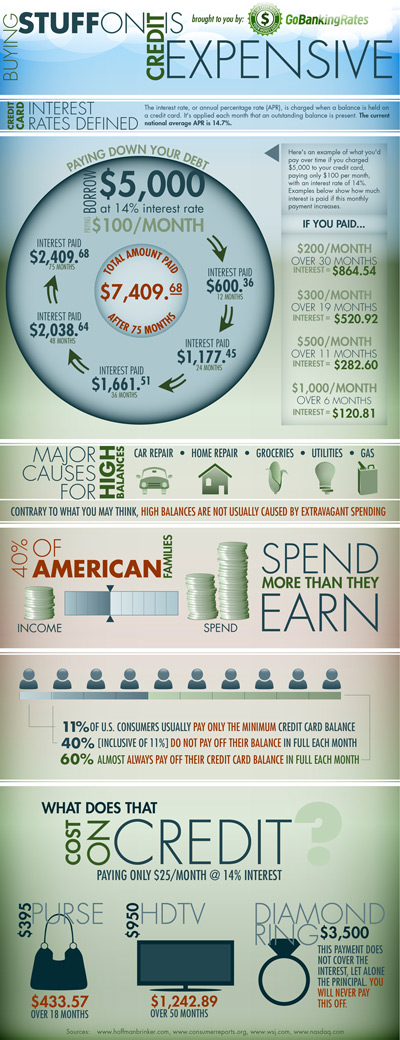

This infographic from Go Banking Rates offers a look at just how expensive it can be to make purchases using credit:

As you can see, there is some solid information on this infographic. I found it interesting that 60% of Americans claim that they nearly always pay off their credit cards each month. This is good news, if accurate. The fact that our society is moving toward less debt is a positive development. However, the stat that 40% of American families spend more than they earn shows how far we have to go. (I suppose it’s no coincidence that this number is the same as the percentage of Americans that do not pay off their balances each month.)

For those who do not pay off their balances each month, the financial consequences can be significant. The infographic shows that if you have $5,000 in credit card debt, at a 14% annual rate, it would take 75 months to pay off your debt. That’s a little more than six years! And that applies only if you aren’t occasionally charging more on your credit card as some of the balance is “freed up.” In the end, you will pay a little more than $2,400 in interest, bringing your total pay off amount for that $5,000 to $7,409.68.

No wonder credit card issuers prize customers that pay little more than minimum, and who continue to add charges to as they make a room. The interest paid goes straight to profits, lining the pockets of executives. Remember that your responsible behavior is not actually preferred by credit card companies; a “good” customer is one who can afford to keep paying interest on a balance.

You can reduce what you pay in interest by increasing what you put toward your debt payments. Paying only the minimum will result in a long, slow slog. The infographic shows what happens if you pay more per month. If you could pay $500 a month instead of only $100 on the $5,000 example, you would have it paid off in 11 months, and only pay $282.60 in interest – getting rid of credit card debt that much faster.

Finally, I really like how the infographic shows the real cost of common items put on credit cards. Assuming that you pay only $25 a month on some items, at 14% interest, you can see how an expensive purse becomes even more expensive on credit, and how you end up paying $1,242.89 on a $950 HDTV over the course of a little more than four years. And, of course, you would have to pay more than $25 a month to reach the minimum on a $3,500 engagement ring, but the comparison shows how failure to make ground on the principal can result in never paying of the debt (and whole new look at “till death do us part”).

There is something about seeing it right in front of you that makes me thing – INTEREST is a CRAZY waste of money. It is fascinating how many people still buy things on credit.

If I had credit card debt I’d paste a mini version of this on my wallet.

Can you imagine if credit cards actually had a warning on them? Haha.

Warning: may cause serious damage to your bank account.

What I think is more amazing than the extra cost (an extra $35-$40 for a purse isn’t a huge deal), I can’t imagine having those payments hanging over my head for so long!

If you can’t pay for it LONG before you finish using it, there’s no way it’s worth it. Imagine being in the situation of paying for something every month that you no longer use! You’d be motivated to pay it off pretty quickly, right??

I bet a lot of people do just that! But since it’s usually not one item on their credit they don’t realize that the clothes they no longer wear (for example) are still earning interest.

It’s not just the financial cost that one endures when paying on credit cards. It’s also that grinding feeling that you’re wearing “concrete boots” whenever you have to write a check to a credit card company. The feeling of not having to worry even a tiny bit about what fees and charges credit card companies are levying on those who choose (and it is a choice) to use them is exhilarating!

I’ve been free of credit cards for over seven years, and don’t miss using them at all.

Man, I used to HATE writing out checks for my hard-earned money every month.

I really don’t believe that 60% of Americans pay off their CC debt every month. I am sure someone smarter than I (or with a lot more time on their hands) could figure it out using the savings data and the financial statements of Visa.

I’m not sure the details behind the figures. Could be that’s what people “say” they do.

Awesome visual! I’m a big fan of cash back credit cards, but I pay them in full each month. The only debt I have is my mortgage, and that is the only thing I plan on having in the near future (and I try to pay extra on it each month). 🙂

Agreed. I’ve gotten lots of gift cards out of my credit card use (also paid in full every month).

Carrying debt on credit cards is just silly in my eyes. I do have one credit card that we use sometimes, but as soon as it hits the account, we pay it off – we never pay interest. For others, it may be better just to cut those cards up – they’re a millstone around your neck!

It’s a hard thing, credit card debt!

What a great, yet disturbing, infographic. Thanks for sharing.

Yes, it is disturbing when you see how interest adds up!

Great visual! This is the type of poster that should be hanging up all over college campuses (actually in high schools)!

The more people can know about this the better.

The one about 40% of Americans spending more than they earn is sickening! I knew it was high, but 40%!? Wow! That’s just ridiculous!

It makes the current economic mess make a little more sense, no? All that spending catches up at some point.

Credit cards are best used with discretion and as a short time-shifter. If payday is in two weeks and you know you can pay it off without interest, then OK. On the other hand, if you really can’t afford that TV, maybe you should think twice about buying it. Those charges really can be a killer over a long period of time.

Just because you have room on the card it doesn’t mean you can actually afford it. I think a lot of people get this mixed up.

I think I need to print that out and tape it to each of my credit cards as a nice little reminder.

I learned a hard lesson with credit cards. I never would have thought they put on large interest on overdue payments. Using a credit takes a lot of discipline and self control. 🙂

dont spend your time and money on a stupid stuff, spend your time with tsladies ladies for free