It’s a common theme on the news and in the papers, the cost of virtually everything is going up and more and more families are finding it harder to keep up with monthly expenses, let alone what happens in an emergency situation, especially a medical one. As health care costs rise and medical insurance costs increase astoundingly fast, a medical emergency can complicate the finances of any family. It is especially tough on those who require prolonged medical care and prescription medication.

What happens when you need to seek treatment but do not have the money to cover the costs? For many, a seemingly easy fix is to pay on credit in order to get immediate attention but financially it may not make sense, especially if you do not have a cash plan to cover the monthly costs. In addition to failing health, you may be faced with long-term financial stress. By charging your health care costs to a credit card, you are going to end up forking over much more money than you otherwise would have to thanks to increased costs and potentially over the limit fees for any missed payments. Credit limits will also take you only so far. For prolonged treatment, your credit limit may quickly be maxed; not to mention the changes being made by the credit card companies which are reducing credit amounts and increasing interest charges.

If you have a credit card that offers a cash back rewards program based on purchases made, it might be beneficial to use it for the money coming back to your account or your wallet. However, that alone is not a reason to use your credit card for medical treatment. There are more viable alternatives for paying for medical care. If you are unable to come up with the cash for payment, perhaps the following list can help you find other options.

Start An Emergency Fund

Even if you don’t anticipate an illness occurring (who does?), you can make a point to have a small amount of money each month transferred to an interest-bearing savings account, where it can grow and be available for medical emergencies. With insurance, there are many times that the costs not covered can still run high and it can be a great relief to have access to cash in the event a medical situation arises, especially one that requires a hospital stay or long-term medication.

Check In With The Government

There are many medical assistance programs available in communities and on a federal level to help supplement your medical payments. Many people will not consider asking for assistance whether due to pride or just lack of knowledge. There are also many clinics that base payment rates on your income and expenses. You can often get quality medical care for a fraction of the cost if you make the effort to seek out additional help.

Payment Plans With The Treating Facility

Most health care providers will offer some options for a payment plan, depending on your need. Even if you have to make payments for a long period of time, you will likely end up saving money by eliminating interest charges like those tacked on to a credit card. If you don’t have insurance, or find that your insurance does not sufficiently cover all of your costs, the balance amount can be paid down over a period of time without collection action, provided you continue to make regular payments

Medical emergencies and unexpected illness are stressful enough. It is better to be proactive and prepared for the unexpected than to rely on your credit card to get you through your situation. Adding financial stress to physical stress can often be a fatal combination. As health care continues to be a major issue for many in the nation, it may continue to get worse before it gets better. No one can prevent an emergency but by proper planning, one can be prepared for it.

******

Tisha Tolar is a freelance writer providing content for CreditCardAssist.com, where she regularly writes about credit cards, rewards programs and general consumer finance issues.

******

Sign up with ING Direct and get a $25 bonus

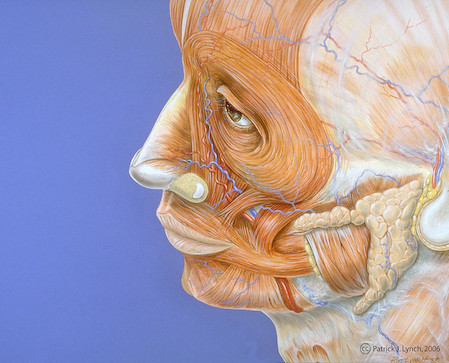

photo credit: Patrick J. Lynch

Don’t forget about Health Savings Accounts. I’m looking into starting one. They are tax advantaged and can be used for medical expenses from dental to vision to prescriptions to hospital stays.

Miranda’s last blog post..Holiday Shopping Trends: Cash is King Again

Starting a emergency fund is a great idea and should be started regardless. Not just for possible health emergencies, but for loss of job, housing problems, etc. Experts say you should save 3-6 months salary in your emergency fund.

@ Miranda – Good idea!

@ Craig – Agreed. Emergency savings are essential. Thing is many people haven’t taken the effort to start one. These days you may be better saving 6-9 months of expenses.

I agree. I get tired of hearing people complain about the cost of health care (I know it’s expensive, I’m self-employed, but I’ve never been without it, I’ve been without cable, but not health insurance). You should save and prepare for a medical emergency just like any other emergency. I think too many people don’t really think about what they’re getting for their health care costs. Many times it’s your life they’re saving – that’s priceless.

Another way to save on health care costs is to maintain a healthy lifestyle. Too many people think it’s way too hard or not worth the work. Then they complain that they have expensive medical conditions and have to take medication or get treatment for them.

I know someone who racked up $50,000 in medical costs (surgeries & other things). They saved his life, literally. But he hadn’t been responsible enough to pay for health insurance for himself so he was uninsured. He didn’t want to pay the bills (even though he would have been able to financially, it would have taken a little sacrifice and a few years), he finally declared bankruptsy to get out of them. All this as a thanks for saving his life.

It kind of makes me mad that so many people aren’t responsible in this area of their lives. Too many people want everything without having to pay anything for it. They don’t want to live a healthy lifestyle and they don’t want to pay for medical costs, but they want to be kept healthy through the health care system.

Susy’s last blog post..OOOOOOO, Opossum

@ Susy – It’s sorta like people who wrack up debt and expect someone to help them out. I agree that a big thing is to live a healthy lifestyle. It’s insurance on your life.

Yes, health insurance is getting more expensive everyday. I also highly suggest a HSA plan as it can really save you a lot of money. You will be building up a nice lump sum in your account for the rainy day. An accident can happen at anytime and you really need to be prepared for it. I would also suggest searching online for several quotes from several different companies. Also talk to a licensed agent who can give you advice.

In my country,Indonesia, as a developing country, we have a lot cases about this. Cost of medical treatment is becoming a major problem for medical professional or business. Mostly there are many ways to cover this matters, Such as using health insurance private or public/government assurance. Using credit card also common for first Down Payment. But we cannot depend on its funding limit. Medical cost sometimes becomes so high that pushed all of the saving out. That’s why as medical professional in my country,sometimes we should adjust the cost to the need of medical treatment. If that so it can make the treatment often quite difficult to choose.

All the more when it is happen to poor people. They cannot have optimal medical diagnostic or treatment since they don’t have emergency fund nor private insurance. Even though we have government insurance for them but there’re always limitation. Generic prescription is the only option for the treatment.

Yeanny’s last blog post..Fetal development: What happens during the first trimester?

I’ve been a bankruptcy attorney in New Jersey for over 20 years. I would say a majority of the cases we get at the office are the result of overwhelming medical debts. People really need to heed this advise. Start an emergency fund/health savings account asap. You never know when/if a medical emergency will strike. and you cannot rely on the government, especially here in the USA.

W.P