In late June President Obama signed into law the the Car Allowance Rebate System or as it’s also known: Cash for Clunkers. This is a program that encourages people to trade in their cars for more efficient models. It also helps to stimulate the economy (similar to the first time home buyer tax credit) at a time when car sales are lagging.

The program runs from July 1st through November 1st 2009. Cars traded in during that time could be eligible for a credit of either $3500 or $4500 depending on the car and the increase in mileage the new vehicle provides.

From the CARS.gov site:

- The vehicle must be less than 25 years old – No digging up a rust-beaten car from the 70’s!

- You must purchase or lease a new vehicle – This doesn’t qualify for used vehicles. Leases must be for at least 5 years.

- For the most part, trade-ins must get 18 miles per gallon or less (when they were new).

- Trade-in cars must have been registered and insured for at least a year prior – No buying a clunker cheap so you can trade it in. This also means you can’t trade in a car sitting in your driveway that hasn’t been registered.

- No voucher needed, dealer will apply the credit – You have to find a registered dealer but after that the dealer takes care of the credit.

- CARS runs until November 1st or when the funds run out – One billion has been set aside for the program so there is an aspect of first come first served.

- The car you’re trading in must be destroyed/scrapped – Remember the point is to get the inefficient cars off the road. The trade-in value will most likely not exceed the scrap value. A dealer will have to provide you with an estimate of it’s scrap-value.

- The car must be in drivable condition – It has to actually HAVE mileage in other words. No towing in a car that doesn’t work.

- The new car must not exceed $45,000.

- You can find your car’s fuel economy at FuelEconomy.gov.

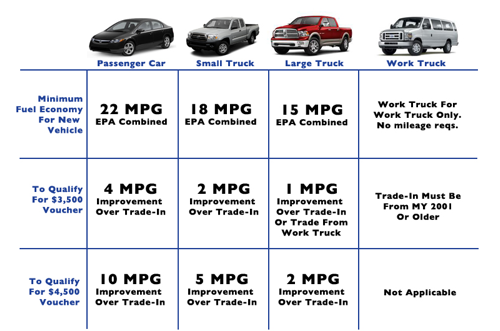

Jalopnik has a great chart on what your trade-in value will be based on the car type and mileage:

This sounds like a great program but it has it’s limitations.

Cars that are traded in have to be not worth too much and also get poor mileage. Thing is, a lot of people who drive a car that fits that description may be driving them for a reason – they can’t afford a new car. The credit helps but those that couldn’t afford a new car probably couldn’t even with the credit. Also, some cars would be more valuable as a straight trade-in rather than using the Cash for Clunkers credit. This limits the amount of inefficient cars that get taken off of the road. Then there’s the dollar amount and time frame. The program is only set up to expire either after November 1st or until $1 billion in credits have been given out – whichever comes first. Countries in Europe have less stringent rules and have seen car sales improve dramatically. The US rules may limit the effectiveness of the intended program.

It’s a good idea though. This could help get some inefficient cars off the road while boosting cars sales. Even if many don’t qualify it still might make them consider trading in their car for a new model. The full details of the Cash for Clunkers program won’t be finalized until later in July so we may see some changes that make it more appealing.

In theory, it’s a good idea. And it will probably help to a certain extent. Of course, it is still frustrating that you have to buy new in order to take advantage of the credit. It would really help a lot of local businesses if this credit, and the new car tax credit, applied to used cars as well. There are plenty of fuel efficient used cars out there.

.-= Miranda´s last blog ..Tuition Hikes Slow =-.

Agreed, in theory this sounds good. I think it needs some fixing to really take off but I guess any help is good.

Thanks for the link to my article talking about the limitations of the program. I really do think that the program isn’t going to do much of anything. By one acocunt I read only 5% of the cars on the road would qualify, and of those cars only a small fraction would probably be turned in under the program. An interesting idea, but I don’t think it’s going to do much.

.-= Bible Money Matters´s last blog ..10 Tips To Help Sell Your Home Fast In A Down Market =-.

I guess we’ll wait and see. It’s certainly not a long term environmental fix as it expires in November. Let’s see if it helps stimulate car sales at all.

Cash for clunkers is a temporary fix. A better way to increase car sales is just to restore the amount a person can claim when they donate car to charity back to the book value. since many donated cars are recycled anyway, there is also an environmental benefit with this plan.

That’s an interesting idea. Maybe that needs to be done as well.

I don’t think this bill will benefit very many consumers or the environment… I think it was mostly intended for the auto industry. But who knows? Maybe it will be wildly popular and effective?

.-= Patrick´s last blog ..Ally Bank Review =-.

If it was more for the environment it would be longer lasting and I think it would need better mileage standards. The government can come up with better incentives to help the environment. I think this is more as a stimulus so we’ll see if this actually helps.

Still, if a person were in the market for a new car then this is definitely something to look into.

Aw bummer, this all sounded like a fabulous deal for our 15-yr old car with 192,000 miles that still runs, except its MPG is apparently TOO good! Ah well, guess it means we can hang on to it with no weight on our conscience.

Cash for clunkers is stimulating new cars sales at the expense of auto repair shops, auto parts stores, used car dealers and car donation charities.

The cash for clunkers helped out New car dealers, but it had a huge impact on small family owned used car lots. We went from selling 10 cars a week to only 2-3 per week for about 6 weeks because of this program. Now in October it still has not returned to normal sales as we are only averaging 6-7 cars per week. Plus prices at the auto auctions have gone up for used cars.