An IRA can be a great tool to help you save for retirement and the traditional and Roth both have interesting tax advantages. But the amount you can contribute every year is limited. The Federal government imposes limits as to how much money can be contributed to both the Roth IRA and the traditional IRA accounts. An account holder’s age (and income) is also a factor in how much s/he can contribute per year.

The investors who are 49 years old or younger have had maximum limits that are $1,000 less that those investors who are 50 years old or older since the 2006-2007 investment year.

The nature of this investment fund demands that an investor contributes the maximum amount of contribution allowed every year in order to enjoy maximum yield. For example, the contribution amount for a person 49 years of age or younger in 2010 was $5,000. If he only invests $3,000 in 2010 he can’t add the $2,000 deficit to the $5,000 contribution allowed in 2011. The IRA is a “use it or lose it” investment fund which means any money not invested into an IRA is lost forever.

The contribution limits for 2011 IRA’s are as follows:

Age 49 and below: $5,000

Age 50 and above: $6,000

Contributions are made from earnings such as wages, salaries, commissions, self-employment, alimony or separate maintenance and nontaxable combat pay. One cannot invest in an IRA account from property earnings and profits, interest or dividend earnings, annuity or pension, deferred compensation, income from certain partnerships, or any other amounts not included as income.

There is one major difference in a traditional IRA and a Roth IRA and that is how the IRS taxes them. The traditional IRA contributions are tax deductible and funds are not taxed until they are withdrawn. The Roth IRA contributions are taxed immediately and withdrawals, including principal and interest, are not taxed (the money used for a Roth is after-tax and you don’t get a tax break upfront like a traditional IRA). Many younger investors choose a traditional IRA to save the amount of taxes they pay during their working life.

There are also many investors who take advantage of having both types of IRA retirement accounts. They choose to defer some of their tax payments until after retirement with a traditional IRA and keep their retirement income partially tax-free with a Roth IRA. The contributions made to both accounts must total the contribution limit.

Other differences in the traditional and Roth IRA accounts are:

• Withdrawals from a traditional IRA can begin at 59.5 years old and become mandatory at age 70.5 while there is no age requirement with the Roth IRA. If a withdrawal is made before age 59.5 a 10% penalty is assessed.

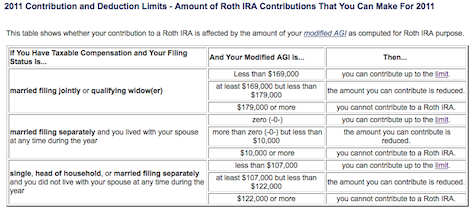

• There are no restrictions on the level of income in the traditional IRA but investors must meet a certain income level according to the tax filing status of single, married filing joint, or married filing separately to be eligible to open a Roth IRA account.

The chart below (from IRS.gov) shows the phaseouts for contributing to a Roth IRA based on your modifies AGI:

The most important decision to make about an IRA is to get started immediately. If you are a young person just starting your career you have the advantage of many years of accumulating retirement funds. If you are 50 years old or older you still have time to invest toward retirement. Retirement years are coming whether you are prepared or not!

Thanks for the reminder about ROTH IRAs. I just automatically put that money away before I even am tempted to spend it. I think $5,000 a year for future retirement is definitely work giving up some more frugal spending.

Absolutely!

I’m on semi-automatic right now – I transfer money into a sub-account in my ING savings account every month called “retirement.” A couple of times a year I’ll take the money and invest it in my IRA.

Any idea why the limits for IRAs are $4,000, while 401ks are around $16,000? With all the talk of financial reform in the past few years I wish congress would eliminate this discrepancy. The investment choices in my 401k suck, but I’m limited to how much I can contribute in my IRA to a fraction of what I could contribute to a 401k…