Lending Club is an online website that offers a unique borrowing and investing model to individuals who need funds and those who are looking to make some money.

Credit-worthy, pre-screened borrowers are paired up with savvy investors in what Lending Club calls a win win situation for all. Peer to Peer or Person to Person lending is the basis of the site. Investors sign up to make money and borrowers sign up to reduce their cost of paying back debt. In summary, investors fund loans for approved borrowers. Borrowers save over bank interest rates and investors profit with returns as high at 9% annually (about the average).

Information for Investors

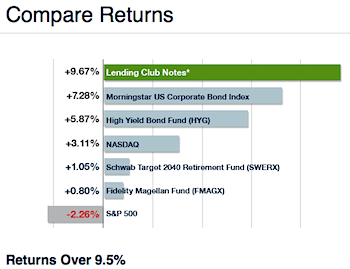

Investors make their money from Lending Club when they invest in 3 to 5 year notes. Investors get to choose which notes they want to purchase by looking through selection criteria. Once you purchase a note you will then begin to receive monthly payments directly from Lending Club as the note is being paid back by the borrower. Lending Club will take 1% of each payment for their fee and you get to keep the rest. You make your money on the interest collected. Since 2007, when Lending Club was launched, investors have earned, on average, a net annualized return of 9.5%.

To ensure your investment is secure, Lending Club has tight lending standards and as a result approves less than 10% of all lending loan requests. Pre-screened borrowers must show they are credit worthy. They have an average FICO score of 715 or higher and are able to demonstrate their ability to pay back the loan. To date, less than 3% of all loans processed through Lending Club have gone into default. Investors are able to spread out their investments over multiple notes to help keep their risk to a bare minimum.

At any time if you decide you want to liquidate any of your notes you can post them on the Lending Club platform and sell them to another investor. Most notes are sold in 5 days or less.

Lending Club is available for investors in the following states: California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kentucky, Louisiana, Maine, Minnesota, Missouri, Mississippi, Montana, New Hampshire, Nevada, New York, Rhode Island, South Carolina, South Dakota, Utah, Virginia, Washington, Wisconsin, West Virginia, and Wyoming.

Information for Borrowers

Borrowers can be assured that all of their personal information is secure and confidential. Once you apply online your application will be processed quickly and after your identity is verified and your credit-worthiness is determined, your loan will be posted within about 24 hours to the Lending Club Platform for investors. Most loans are fully funded within about seven days from being posted.

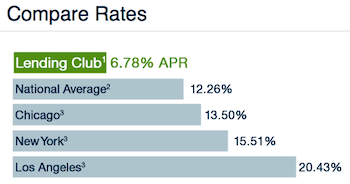

Borrowers are offered great savings over loans obtained in other ways, especially credit card debt. Many of the loans approved at Lending Club are to pay off credit card balances. Additionally, funding is typically approved for such things as home improvements, small business expenses, large purchases or other one time large expenses.

Borrowers will pay an origination fee to Lending Club anywhere between 2 and 5% of the total loan amount. Loans are available for as little as $1,000 on up to $25,000. Each borrower can have two loans through Lending Club, but after the first loan is processed the borrower must wait six months before applying for a second loan.

Borrower Requirements (from the Lending Club site):

To borrow through Lending Club, you must be a US citizen or permanent resident, and at least 18 years old with a valid bank account and a valid social security number. To list a loan request, you will need a FICO score of at least 660 with a debt-to-income ratio (excluding mortgage) below 25%. In addition, your credit history must show that you are a responsible borrower:

* – at least 3 years of credit history, showing no current delinquencies, recent bankruptcies (7 years), open tax liens, charge-offs or non-medical collections account in the past 12 months,

* – no more than 10 inquiries on your credit report in the last 6 months,

* – a revolving credit utilization of less than 100%, and

* – more than 3 accounts in your credit report, of which more than 2 are currently open.

At this time, we are not accepting loan applications from the following 8 States: Iowa, Idaho, Indiana, Maine, Mississippi, North Dakota, Nebraska, and Tennessee.

What Is Being Said About Lending Club

Investors and Borrowers come to Lending Club because borrowers are able to obtain better rates and investors are able to receive a better return for such a low risk investing option. Many top publications have acknowledged the efficiency of the Lending Club Peer to Peer Model including the NY Times, Washington Post, Fox Business, Forbes and CNN.

An article posted on Forbes.com reported that , “Lending Club is one of a handful of peer-to-peer lenders filling a gap created by tightfisted bankers.”

In Summary

Lending Club provides investors and alternative to the stock market and the low returns provided by CD’s. Diversification through multiple notes can help an investor achieve a return of 9% or greater. The site is easy to navigate and you get to choose the loan you want to invest in. There is still risk for an investor, like a borrower not paying back a loan, so an investor must be careful what they invest in. Also, an investor’s returns will be taxed like income compared to how long-term capital gains are taxed for stocks (something to keep in mind, though using Lending Club’s IRA is an option to keep taxes lower).

For borrowers, Lending Club provides a place where they may be able to get a loan at a lower rate than what would be available through a bank. Lending Club is online, and quick and easy to use. A loan through them can be a great way to consolidate credit card debt and pay it off at a lower rate than what a credit card might offer. Lending Club can also provide a source for loans for any number of reasons including home improvements, funding a home business, consolidating debt, and more.

Visit www.LendingClub.com to sign up as an investor or borrower.

I’ve been meaning to check out LC for a while now. I read a recent article in Fortune about the founder of the company, and that was pretty interesting. He had some experience in banking but decided to go the route of lending money to credit worthy friends (obviously). Both the business model and incentives are in line for investors and borrowers. I think this company will do well–investors essentially get to play the role of banks and have the ability to make loans the same way.

I like the way investors can choose where they want to lend their money rather than hove someone else do it for them.

LC has been asking us to become affiliates. I was going to research more into them in the new year – thanks for the head start!

The thing I will need to confirm is that they do indeed lend to Canadians as that’s who we are!

Thanks for this article.

@Sustainable PF – LendingClub requires you to be a US citizen to lend or borrow. Peer-to-peer lending has had a tough go in Canada. A few have tried but quickly run into legal red-tape that shut them down. The only one I am aware for Canadians in CommunityLend (and only in 3 provinces right now), but their eligibility requirements for becoming a lender there are pretty high (you need to be certified as an accredited investor which means you need $1M in assets and an income of at least $100k/year).

I do hope this sort of thing finds its way to Canada, but I’ve been waiting years for that to happen and we don’t seem any closer.

Why isn’t Lending Club available in all states?

Hey Glen,

I’ve been a Lending Club investor for over 2 years now and getting 11.54% NAR.

@Jenna,

Unfortunately per investment requirements each state can approve/disapprove this type of investment. A way around this is purchase notes on Lending Club’s secondary market, but I would not recommend it as their secondary market isn’t very functional.