Prosper.com is a personal loan and investing site with over one million members and over two hundred fifteen million dollars in personal loans funded since 2006. Using a unique person to person lending model, prosper.com connects borrowers and lenders and allows them to establish a mutually beneficial financial relationship. Prosper offers borrowers rates as low as 5.9% and lender returns as high as 10.1% (this varies, of course based on your borrowing and lending situation).

What is Person to Person or Peer Lending?

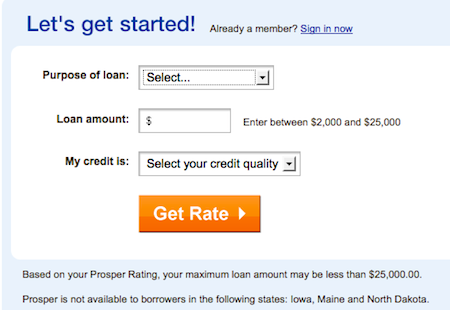

Person to person lending (or peer to peer/p2p) eliminates the middleman. Rather than having to go to a bank a borrower can go to prosper.com, post their loan, and have it funded by investors. A borrower creates a profile with personal and financial information. This information includes credit ratings, past loan history, income and expenses as well as personal information such as the amount and purpose of the loan. Loans range from two thousand to twenty-five thousand dollars. Prosper rates each borrower based on their financial history.

Lenders, or investors, have two options for investing in borrowers. They may browse detailed borrower portfolios and choose who they wish to invest in and how much to invest in each borrower. Or, to avoid the lengthy process of selecting individual profiles, lenders can set up criteria and then allow Prosper to automatically invest according to the set criteria. Investors also can buy and sell existing notes.

Once a loan is fully funded by investors, Prosper deposits the amount of the loan to the borrower and sets up a payment plan with fixed monthly payments to begin repaying the loan. The lender receives a direct deposit to their Prosper account each month.

How Much Does it Cost?

Prosper.com clearly lays out all fees associated with borrowing, and there are no fees until the loan is in effect. Borrowers pay a closing fee that is based on both the amount of money they borrow and their Prosper rating. Fees for failed or late payment are clearly explained. Lenders pay an annual service fee of one percent. Lenders do risk a loan going to collections if the borrower defaults. The fees associated with collections will vary based on the agency Prosper assigns to the loan.

Advantages to Borrowers

Borrowers are attracted to peer to peer lending because of the low interest rates and low fees. Unlike traditional bank loans, a Prosper loan is quick and hassle free. Forms are completed online and because there is less overhead, there is less paperwork and fewer steps to process and complete the loan. Your loan on Prosper is also an unsecured loan. This means you don’t need to put up your house or your car in order to get the loan.

While excellent credit is helpful, Prosper gives borrowers the opportunity to sell themselves to investors based on criteria other than financial history. Loans on Prosper have many uses from typical situations such as buying a home or car, consolidating debt, and business loans, to more unusual loans such as funding an adoption or wedding.

Borrowers can use Prosper’s tools to see what a possible loan will actually cost them, what their monthly payments will be, and their fees for the loan.

There are also no pre-payment penalties so a borrower can pay back their loan quicker and lower their interest owed.

Advantages to Lenders

Lenders not only see a high return rate, but Prosper also allows them to diversify investments. There is relatively low risk associated with a peer to peer loan because lenders invest a small amount (as low as $25) in many different loans (there’s always some risk but you get to spread it around many loans). Lenders choose who they are investing in and can lower their risk by being selective in their investments. Prosper loans allow investors to choose where their money goes and invest in loans that are relevant or important to them.

By directly connecting borrowers and lenders, Prosper provides a unique service that allows benefits to both borrowers and lenders and eliminates the high fees and complexities of a traditional financial institution. It also allows for lower interest rates for borrowers and higher returns for lenders. For a borrower, Prosper can mean the the ability to get a loan where a traditional bank may not allow it.

Check out Prosper for yourself for more details.

I’ve been wanting to check out peer-to-peer lending (as a potential lender). I like the idea of being able to spread the risk among lots of loans — like you’re holding a mutual fund of loans. I haven’t tried it yet, nor do I know anyone who has ….

I’ve heard lots of people who are satisfied with peer to peer lending for investing. I have to admit I haven’t invested yet but I plan to do so.

I too am curious about this form of investing. I know there are other providers out there. Any knowledge or thoughts about them?

The other big peer to peer lender I know of is Lending Club. Feel free to check out my review of Lending Club and see which site is better for you.

I have used Prosper since it first launched (wow…maybe about 5 years now!). I love it. The key is to invest small amounts across a lot of loans. I do $50 loans, and over the 5 years, I have had an annual return of about 10.5%. I have had about 18 loans default, currently about 9 in default, about 60 regular active loans, and so far, about 32 have been paid in full. I just keep reinvesting!

That’s a nice return.

From what I understand, what you are doing is the key to keeping diversified and getting a good return. You still need to evaluate the loans though, as I’m sure you can still have a lot of loans and high risk.

terrible customer service experience , no sense of professionalism , none what so ever. I NEVER RECOMMEND IT TO NO BODY

I just secured a loan for a home improvement project through Prosper.com last month. Overall I found the site easy to use and enjoyed seeing real people fund my loan while it was listed. A much more satisfying process than going through one of the bailed out banks. And ~9% for an unsecured loan isn’t bad at all.

I have been making loans on Prosper for over three years with good results.

Presently I have more than 900 loans out which although it sounds like a lot of loans takes almost no time to mangage. A couple times a week I reinvest the money in payments and interest into more loans. My overall rate of return is better than 12%.

That does sound like a lot of loans. Great return though! Glad to hear Prosper works for you. Thanks.

Visit poppen for the best free sexy chat contacts with hot sexy young local girls!