My Money Blog posted an article a few months ago talking about the theory of “price targeting”, where companies try to sell the same product to different people at different prices, hoping to come as close to an individuals’ target price as possible. In the use of price targeting, shoppers are generally broken down into three categories.

• Impulse shoppers that buy things when they see them

• Necessity shoppers that buy things when they need them

• Bargain shoppers that buy things when the price is right

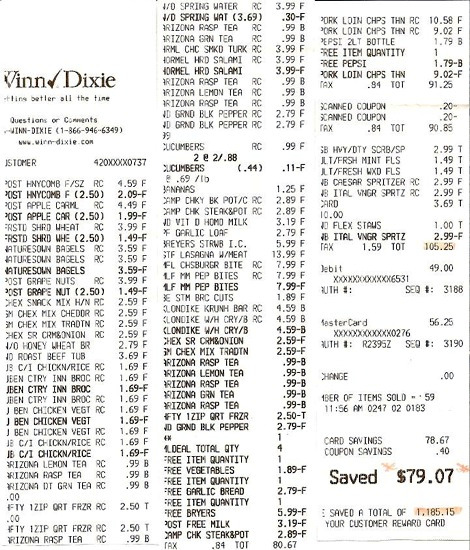

If I were to be classified, I may have to add a 4th category for extreme money savers that ONLY buy things when they are on sale, preferably buy one get one free. To show you what I mean, I’ve attached my most recent Winn Dixie experience (that’s what they are) receipt, where I saved $79.07 on a $105 grocery bill.

Could I have done better? … absolutely. If it weren’t for some luxuries like dish sponges and dental floss I could have saved as much as I spent (which happens sometimes). Some people will think that I’m living a restricted life, only buying what manufactures tell me to buy, but I beg to differ. I think my method of madness is saving me thousands of dollars a year AND I’m still able to buy whatever I want and eat whatever I want. Let me explain.

Just because things are on sale does not mean that I buy them. Even though my girlfriend and I are not picky eaters, we only buy things we love, or things we’ve never tried before. For example, we just purchased Mighty Bites, something we’ve never seen or heard of before but at half price, definitely worth a shot. We’re lucky enough to have two major grocers in our area, Publix and Winn Dixie, so the carousel of sales never stops. Every week, we receive a circular, which tells us what’s on sale, and we plan accordingly.

The beauty about food is that it usually lasts a long time. Meats such as beef, pork and poultry, which are our main proteins can last 4+ months in the freezer. So when I see a sale for half price boneless, skinless chicken breasts, I expect to come home with at least 20+ pounds of it. I bag it, tag it, and slide it into the freezer for whenever it’s needed. The same is true for canned and frozen vegetables, pasta’s, drinks of all kind, soups, cereals and everything else that can survive after a couple of weeks. Pretty much anything that’s not in your grocer’s produce, dairy or bakery section will last a good while if you take care of it.

Even though I stock up on a large number of non-perishable products, I still buy an ample amount of fresh fruits and vegetables, bread right out of the oven and a wide variety of dairy products. I would estimate that we spend around $3,000 a year on groceries when you combine both supermarket chains, and I would also estimate that we save around $2,400. (The Winn Dixie receipt shows a savings of $1,185.15 so far this year). Grocers are always having sales on center cut chops, pot roasts, London broils, skewers and thousands of other high-ticket items that I buy and tuck away. Cooking at home often allows me to try new things at a reduced price, which always makes things taste a little sweeter.

While my method of buying groceries is certainly not for everyone, it allows me the freedom to save a little more for that vacation, while still enjoying the very best that food has to offer. I would suggest the next time you go to your local supermarket, be on the lookout for where you can save a few bucks. The savings over a lifetime of frugal grocery shopping could be as large as six figures.

This guest post comes from Michael, a contributing editor of the Dough Roller, a personal finance and investing blog, and Credit Card Offers IQ, a credit card review site.

thanks for sharing pal.

.-= nina’s college´s last blog ..HOW TO STUDY BASED ON INFORNATION RECEIPTION =-.

Since I was a kid, my dad taught me how to get the best deals at the supermarket, using the sales flier and coupons. Now, it’s almost a game to us to see how much we can save off our grocery order. I almost always only buy what’s on sale, but I also won’t buy something we don’t use just because I can get a deal on it.

.-= Rainy-Day Saver´s last blog ..Savory Parmesan Shortbread Rounds Recipe =-.

I’ve seen so many people buy stuff because it was on sale, even when they didn’t need it. Heck, I’ve been guilty too! Being able to curb that urge is huge in helping you save.

Very impressive! I mainly buy what’s on sale. But I don’t think everything we get is on sale. Especially because my husband has ADD, so we generally end up getting at least one thing not on the list. He’s learning limits, though, so we’re getting a lot closer to “list-only” trips.

It can be fun, though, to do the math and see how much you can NOT pay. Each Wednesday, I sit down with the grocery circulars and my coupon folder and check out sales, match them up to coupons and see whether it’s worth a trip to the store. I always fee triumphant when I get cartons of broth for 50 cents or free toilet paper or whatever.

Of course, that’s helped along these days by having moved to AZ. Here, the grocery stores are almost always willing to round your coupon up to $1. That really kicks savings into high gear!

.-= Abigail´s last blog ..Blame Monopoly! =-.

Rounding coupons up?!? That sounds awesome! I haven’t heard of anyplace doing that in NYC.

Wow, I’m not the only one doing this? LOL

We’ve done the shopping the way you described whenever we can. Though this can only be done with advanced planning. Other times we shop in Flushing, where prices seem to be lower than most other places in general.

We definitely take advantage of bogo deals whenever we need the item on sale. I’m actually waiting for such a deal on vitamins 🙂

.-= FrugalNYC´s last blog ..4 Reasons To Eat Grapefruit =-.

Flushing just got a BJ’s Wholesale there so it might be easier to get some great deals.

Buying items only on sale doesn’t mean buying stuff you don’t need. Say we need bread and cereal. We purchase whatever brands of bread and cereal on sale. The key is staying flexible to brands, not just buying anything out there. Of course there are particular foods which I only want in a certain brand (e.g. jarred spaghetti sauce, and I hate all Kraft products). As for produce, if you buy only in season produce, it is always relatively cheap. We play the savings game, too.

I’ve got to find the article on price targeting, I’ve always wondered about that. Around here, if strawberries are on sale at Safeway, they’re likely to be on sale at Giant, too.

Regarding price targeting – I used to work for a supermarket chain. They owned about six stores. Every week the owner would adjust the prices for items. I noticed that different stores charged more than others. We had one in Manhattan that charged much higher prices then the others. Not sure of this is what that article is referring to but it’s still something to consider when you go shopping.