With a divorce rate that is commonly quoted as being 50%, second marriages are common.

However, according to the Wall Street Journal, many experts cite the divorce rate of second marriages to be 40%.

Second marriages come with more baggage — ex-spouses, stepchildren who may or may not like the new step parent, and, of course, financial complications including spousal support and first family obligations, just to name a few.

It’s no secret that money disagreements can be one of the top causes of divorce.

According to a study conducted by Jeff Dew of Utah State University, “Couples who reported disagreeing about finance once a week were over 30 percent more likely to get divorced than couples who reported disagreeing about finances a few times a month” (The New York Times).

So how do those in second marriages, who perhaps bring more money issues and baggage into their marriage with them than they did their first marriage, avoid financial conflict?

One strategy is to have a financial meeting before they marry (and some may argue before they even get engaged).

Make sure to consider these financial topics before that next marriage:

1. Discuss money beliefs.

According to USA Today, “Nearly two-thirds of married couples who responded to USA TODAY’s poll said they talked little or not at all before the wedding about how to combine their finances.” As a couple marrying for a second time, this conversation is essential.

Those entering second marriages are often older and bring more assets into the marriage. They must decide if they want to completely combine finances, keep finances separate, or combine some aspects and keep some aspects separate. How they choose to merge finances doesn’t matter as much as having the conversation and choosing a method they are both comfortable with.

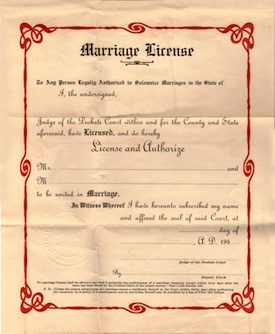

2. Consider a pre-nup.

A prenuptial agreement isn’t romanatic. It isn’t sexy. Bringing up the topic of a prenup can be difficult. Still, if both partners bring substantial assets into the marriage, or if only one person does, having a prenup can be essential.

Partners who have already been through one divorce know what a messy and long process dividing assets can be. A prenup will take away that battle should the second marriage not work.

Carole Cox, a college professor, says that having a prenup when she got married for the second time was the smartest thing she did. ” Her second marriage ended in divorce. The prenuptial agreement is the primary reason she was able to keep her house and pension in the bitter split. It also helped save her from having to pay spousal support to her long-unemployed ex” (LA Times).

3. Update wills.

Life gets a little more complicated when people marry for the second time. If one or both partners have children, discussing who gets what in the event of death is essential.

Violet Woodhouse, an attorney and author of Divorce and Money, explains, “State laws kick in when the couple has no legal agreement to the contrary, and those laws can subrogate children’s interest to the interest of a stepparent in the event of death. In divorce, they can enrich a jettisoned spouse, even if the union was short and rocky” (LA Times).

We have a family friend, Susan, who just passed away. Susan was married for the second time, and her daughter, Wendy, inherited the house when Susan died. However, Wendy’s stepfather, who she is not close to and whose name is not on the mortgage, still lives in the house. Now Wendy is in the uncomfortable position of deciding if she should let him continue to live there or if she would like to take the house or sell it. Had all three sat down together first and clearly defined the situation, Wendy wouldn’t be in such an awkward position now.

4. Update beneficiaries.

Ask any financial planner or lawyer, and they will pass on sad stories where a beloved second wife or husband doesn’t inherit anything because the spouse forgot to change beneficiaries from the first wife or husband to the second.

Before people marry for a second time, they should sit down together, discuss beneficiaries, and make any changes that may be necessary. Consider all documents like life insurance taken out independently as well as life insurance received through the bank or place of employment. Also consider stocks, retirement accounts, and bank accounts.

Finally

Second marriages bring with them additional financial complications. While discussing finances so openly and business-like may not feel romantic or sexy, the simple fact is that such conversations may help strengthen a second marriage. And if the second marriage doesn’t survive, at least each partner has taken steps to protect his or her assets and children from the first marriage.

The divorce rate hasn’t ever been as high as 50% of first marriages, think goodness! It’s closer to 20-30% of first marriages over the lifespan of the couple. People who divorce once are much more likely to divorce a second time, and by the third marriage, divorce is more likely than not. So the percent of ALL marriages that end in divorce are higher than first marriages that end in divorce.

It’s an interesting thing isn’t it? You’d think the more you do something the better you’d get at it.

I think key in a lot of this is having clear communication and preparation prior to the second marriage so both parties are on the same page when they start out. Of course, this is important with any marriage but plays a more unique role in the second marriage with the increased possibility of additional baggage coming in.

Exactly.

Excellent post and advice. Like most aspects of financial planning a little upfront planning goes a long way especially when one spouse dies or if the marriage ends in divorce. Its always easier to specify what will happen upfront then to try to unravel a mess when some event occurs.

I can’t even imagine what kinds of emotional turmoil people go through trying to figure out what goes where after a death.

If you are not starting out equally financially, you need a prenup! Second marriages definitely should have a prenup. I say this a someone who has been married nearly 45 years!

I think that #4 is very often overlooked when people get divorced and then remarry. It will become very apparent if it was when a new spouse dies and the money goes to the old one after some type of accident occurs.

It’s just another reason you need to keep track of all of your financial accounts. It’s too easy to forget about something like an old 401(k) (though I’d prefer to transfer an old 401k to an IRA I can control).

I am on my first and Lord willing my only marriage. I am the second wife however, and my husbands ex left him in the red in his bank account and credit, etc. He let her handle it all and then realized she was paying half the bills, and spending tons on luxuries. He and I handle the finances together, as he learned his lesson with her. We are both involved and know where the money is. Neither of us were in great financial shape, but we are working on it now.

come and have a chat with geile mädchen girls