Capital One 360 Checking online checking came through for us and I want to tell you about it.

See, we’re having some work done our house. After a few estimates we settled on one contractor to do the work. He had a great plan and the price was good. All he needs is a check for a deposit so he can started ordering supplies and such.

No problem, right?

Ends up we ran out of checks. Major oops! We knew we were on the last book and had to re-order but I guess the bills overtook the checks and we ran down our checkbook quicker than we realized. So we have no checks.

I re-ordered checks of course, but it will take a little while for them to get here. The contractor is great and told us we can mail him a check as soon as we get a chance. But the sooner he gets a check the better. What to do?

Enter Capital One 360 Checking!

I remembered that the 360 Checking account had a feature where they will send a check out for you. I never used it before. I always liked to send the checks out myself (and maybe I was a little stubborn in sending out checks over the internet). This seemed to be a perfect opportunity to try out 360 Checking’s check writing feature for myself.

360 Checking has a number of different ways that you can make a payment. To get to the options, I went into my 360 Checking account and click Make a Payment.

How to send a paper check

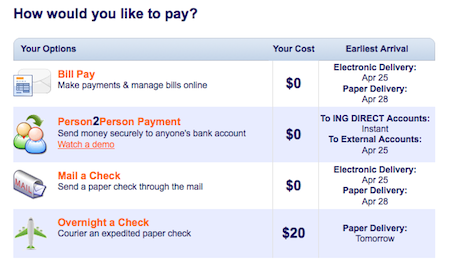

I saw options for the following payment types:

- Bill Payment (to pay bills like utilities and such);

- Person2Person Payment (this lets you send money to another person’s checking account;

- Mail a Check (where Electric Orange will send out a check for you – the option we’re doing here); and

- Overnight a Check (same as Mail a Check but it will be overnight-ed for an additional fee of $20).

From here I picked Mail a Check (I didn’t want to pay extra for the overnight service).

From here I picked Mail a Check (I didn’t want to pay extra for the overnight service).

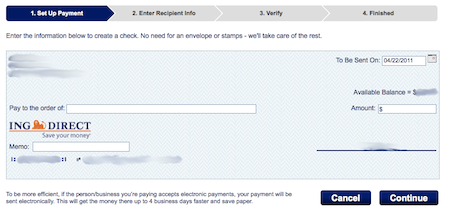

I then saw a blank check on the screen. Just like a physical check, I fill in the information for the check like Pay to the Order of, Date, Amount, and a Memo (my name and address already appear in the upper left). If you notice in the screen shot below, above the Amount you have the Available Balance in your account.

I hit continue.

I hit continue.

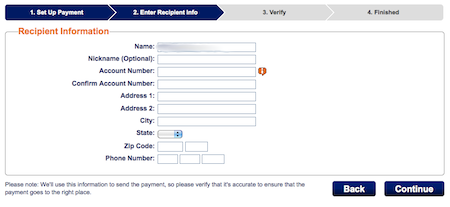

Now I enter in the recipient information. This is where you will be sending the check out to. The name is already filled out from the previous check screen. If you know the account number of the person you are sending the check out to, you can enter that in this screen. Doing this will have the funds hit the other person’s account much faster.

Hitting continue brings me to the next screen which shows a picture of an envelope with the recipient’s name and address as well as my info (just like an envelope I might use to mail out a check).

Hitting continue brings me to the next screen which shows a picture of an envelope with the recipient’s name and address as well as my info (just like an envelope I might use to mail out a check).

Under the envelope is a summary of the information on the check such as the amount and who it’s made out to. This is a double-check to make sure everything is correct.

I hit submit and DONE! There’s now a check in the system that is scheduled to be sent out.

The recipient and the address are stored in your 360 Checking address book if I should ever need it again.

Going into my account again, I see that the check is set up to go and I still have the option to edit things if needed.

The system tells me when the check should arrive at the recipient, which seems to take about a week, including weekends. You can also see how long a check would take on the initial Payment Options screen.

Overall, the process is pretty easy.

I mean, it’s really the same as writing out a check and an envelope, I’m just doing it on a computer screen. What’s great is I don’t need an envelope or stamps since Capital One takes care of that. They mail out the check free for you!

I definitely see myself using this function more in the future.

One thing I like is I have my account information right there before I write the check. I know how much is in my checking and my savings which makes it easy to manage checking and make sure I don’t overdraw the account. For example – the money I needed to send out on the check I transferred to my checking from my savings account. I don’t have to worry about keeping extra money in my checking. I can use what I need and let the rest sit in savings to earn higher interest.

Thanks to 360 Checking online checking account we are able to get our contractor a check before we would be able to send one out ourselves!

Have you used the 360 Checking paper check option?

Want convenience like this in your checking account? Sign up for a 360Checking account now.

Note: Some of the screen shots show ING Direct Electric Orange. They were acquired by Capital One and became 360 Checking.

I use online banking all the time! One of the unintended consequences is not buying stamps for years. In addition, the bank guarantees delivery by the date selected. Seems like a winwin!

Indeed it does seem win-win. Not having to deal with stamps or envelopes is huge. I’ll tell you, I would much rather deal online then write out checks and mail (it’s part of why I used to have late payments on credit cards years back).

Hate to tell you Glen, but this is old news. People have been doing this for……..a long time.

The option has always been there but I never used it Mark. I think there are a lot of people who are still leery of online banking.

Not sure when this was written but whether old news or not, it helped me find what I wanted to know faster than searching ING’s website, so glad it’s here! BTW, ING’s overnight check is a cashier’s check, not just an ordinary check: http://helpcenter.ingdirect.com/ingd/topic.aspx?category=eonew2-723