We’ve done a write-up about the closure and what your next steps should be if you have a PerkStreet account: PerkStreet Financial Online Checking is Shutting Down (What Happens to My Money?)

Are you looking for a free checking account that offers more than just basic checking services?

How about an alternative to using a credit card for your purchases (but don’t want to carry cash)?

PerkStreet(SM)’s online checking account is not only free, but offers up a generous cash back rewards when you use their debit card.

Read on for our PerkSreet review.

PerkStreet offers the debit card that helps you get debt free. By using a debit card for your purchases you can  easily manage your money and budget for what you spend rather than risk the possibility of incurring credit card debt.

easily manage your money and budget for what you spend rather than risk the possibility of incurring credit card debt.

Their rewards checking helps further being debt free by giving you up to 25% cash back on purchases (depending on the purchase). They offer free online checking accounts and perks like bill pay, free ATM usage, excellent rewards, easy mailed-in deposits, and more.

The premise behind the bank is to offer superior service and you can talk to a live person 24 hours a day with any questions you might have. The company’s focus is to serve people who want to manage their money responsibly and not go into debt with offering generous rewards for debit card use.

PerkStreet Financial(SM) online checking accounts are easy to open only taking about five minutes. Here is what comes with your Perk Street Checking Account:

- Your funds are FDIC insured (FDIC insurance is backed by The Bancorp Bank, member FDIC, who PerkStreet are partnered with).

- Live customer service is available around the clock.

- Use of one of the largest ATM network in the country, for free. 42,000+ ATM’s are available through STARsf, and ATM locations can be found in nationwide retail locations like 7-Eleven, CVS, Walgreens, COSTCO, Target and more. With a quick click on the Perk Street Website or app you can find ATM locations that are closest to you.

- A superior on line banking system where you can check your balance, pay your bills with bill pay, look through your transaction history, set up alerts to be sent right to your mobile phone, transfer money into or out of your account, find ATM locations and more.

- Easy mail in deposit envelopes are available as well. You can send deposits through standard mail, or if you need your money deposited right away, through overnight delivery. Both ways are free. Overnight deposits need to be dropped off at a UPS drop or Mail Boxes etc. location. You can also send cash via MoneyGram Express Payment (free).

- Direct deposit is also available.

Perk Street Financial offers their customers the perk of virtually no account fees.

Here is what you get when you open your checking account:

- There are no fees to start up your account.

- There are no ATM fees as long as you use one of the network 42,000+ ATM machines.

- Your first two (2) books of checks is free and should arrive about one week after you have opened your account.

- There are no mailing fees for check deposits.

- There are no monthly service fees unless your account is inactive.

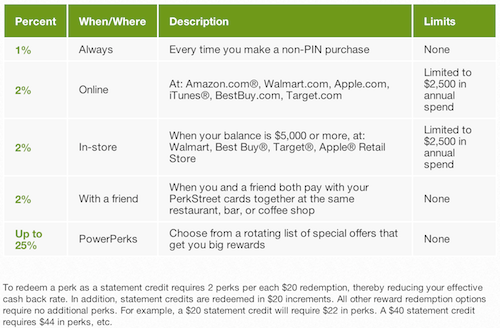

Perk Street Financial offers one of the best rewards programs available for debit card purchases:

- 1% unlimited cash back for all non-PIN debit card purchases*

- 2% cash back on online purchases at: Amazon.com®, iTunes®, Target.com, Apple.com, Walmart.com and Bestbuy.com.* Online purchase bonus perks limited to $2,500 in spend every calendar year.

- 2% cash back in-store, when you have a Current Account Balance of $5,000 or more at: Walmart, Target®, Best Buy® & Apple® stores.* Offline purchase bonus perks limited to $2,500 in spend every calendar year.

- 2% unlimited cash back when you and a friend use your cards together at the same restaurant, bar or coffee shop.* Transactions must occur within 60 minutes of each other to qualify.

- Up 25% cash back with PowerPerks. You can choose from a rotating list of rewards that earn you higher cash back. You will get weekly offers straight to email for in-store and online deals that have been specially picked based on where customers actually shop. There is no limit the the PowerPerks you can earn.

Your rewards can be redeemed for:

- Cash back into your account*

- Choose gift cards from locations like Starbucks, Dunkin Donuts, Olive Garden, Best Buy, Ticket Master, Amazon.com, Gap, Target, and more.

Sync Your Account to Financial Software

Connect your PerkStreet account to financial software providers like Quicken or Mint, among others, to track your finances. If you don’t see PerkStreet in the software look up their partner bank The Bancorp Bank.

No Credit Check

There is no credit check when you apply to open up a PerkStreet account. No worries about not getting an account because your credit isn’t great or having an inquiry on your report. They do run a ChexSystems report to look at your past banking history though.

Summary

PerkStreet’s free online checking account offer up generous cash back rewards on your spending (though not on your balance). Their debit card is easy to use, with a wide range of ATM’s available. They also offer free online bill-pay, virtually no fees, and an online site that allows you to easily manage your account.

Using a debit card from a checking account can be a great way to budget your spending to make sure you don’t overspend like you can with a credit card.

If you are looking for an online checking account, especially one that offers a rewards bonus, then PerkStreet might be the place for you as it seems to be one of the best free online checking accounts.

To get started with PerkStreet’s online checking account visit their website at www.perkstreet.com.

*To redeem a perk as a statement credit requires 2 perks per each $20 redemption, thereby reducing your effective cash back rate. In addition, statement credits are redeemed in $20 increments. All other reward redemption options require no additional perks. For example, a $20 statement credit will require $22 in perks. A $40 statement credit requires $44 in perks, etc.

Debit cards with rewards? That’s pretty cool. I’ll have to check it out.

You definitely should!

This sounds like a great banking service! I wish we had a similar service here in Canada. I really like that they give back to the Hunger Project and the fact they give rewards – WOW.

It is pretty cool. When a bank doesn’t have the overhead of physical locations they can really give more to their customers.

I like the contribution to hunger relief efforts. Good thing to highlight this time of year, especially. Anyway, this product seems to have an interesting mix of features.

I love hearing about companies that give back and it’s great that PerkStreet does that.

I guess I don’t get the obsession with Perk Street. I’m on track to earn $1,500 this year in credit card rewards. I just blogged about it.. I’m at 945 now. Only $35 from Perk Street.

First, it’s only 1% if you balance is below 5K. Second, the 5% revolving perks are usually in ridiculous categories that no one will use. Like– amusement parks. Seriously? What about gas, groceries and restaurants?

And if you want to use this as a checking account, good luck. They limit transfers to $1,500 a month. So basically I can pay my mortgage and that’s it.

I’m closing my account today after a few months. That hasn’t been easy either. This online bank told me to write a letter to cancel. An ONLINE BANK wants me to WRITE A LETTER to cancel! Then they said I could transfer all money out of my account and they might be able to do it via web or phone.

Stay away! Not worth the hassles!!!

Michael,

You need to understand your spending habits (I say that in general, not necessarily you in particular). Sure there are places that have better rewards programs. But for many people a credit card is just too much of a temptation to spend so a rewards program on a CC doesn’t help them. You really need to have no balance on a CC in order to reap rewards. With PerkStreet, you are using a debit card, meaning you spend what is in your account, that’s it. And on top of that you get their rewards.

And yes, after the intro period you get 1% when your account is below $5k. If you keep it above $5k it’s 2%. Both options are WAAY higher than what you would get with most checking accounts (many checking accounts may cost you in fees).

As for the bonus categories, that’s what they are – a bonus. If they don’t work for you then so be it. But I wouldn’t say that no one would use the categories. I think PerkStreet puts consideration into their categories and makes them fun and timely. Think of amusement parks. It’s this time of the year that people buy season passes. That’s a great opportunity to get a cashback bonus. Should you go out and buy tickets because of the bonus? That would be silly. But getting an extra bonus is nice.

Now limiting transfer to $1500 a month – looking at the site’s faq’s it looks like there is a DAILY account limit of $1,500 a day in spending on your debit card but that can be raised if needed. I’ve put in a question with them about bill/pay and transfers.

I’m sorry to hear that PerkStreet doesn’t work for you. There is no such thing as a universal account that works for everyone in every situation. You have to understand your financial situation and find the accounts that work best for you.

Update: According to a response from PerkStreet there is a daily bill/pay limit of $99,000. Probably enough for most of us. There is also no limit to the amount you can move in and out of your account though there is a limit to what you can initiate from PerkStreet (this goes up over time and is in place to help prevent fraud).

We have a Perkstreet account and love it! Over the first couple of months of using it we got $53 cash back and we didn’t even make all of our purchases with it. We highly recommend it!

Nice!

Thanks for adding your positive experience.

Glen and friends,

Kyle from PerkStreet here. I just wanted to drop in and let you know that we have made some announcements about new features, including a new mobile app and savings account. This announcement came out today. I’ll likely see comments left on the PerkStreet blog sooner, but of course, feel free to ask questions or comment here on Glen’s blog as well.

Here’s the announcement on our blog: http://dailyperk.perkstreet.com/perkstreet-mobile-app-savings-account-catcust/

-Kyle

I have a bank account that sounds similar to this! I love the rewards I get from it! If I’m ever in need of another bank, I’ll check this one out!

My friend form Wienna tell me about this web platform for sexy chat with local ladies – nutten! So I tell you now, check out!