So I got a new computer recently. The last one went back to the turn of the century and the screen finally died (the battery had already gone). Anyway for all of the great programs on my new computer I didn’t have a good spreadsheet or writing program. Of course the industry standard is Microsoft Office. Office 2008 for the Mac on Amazon is going for a little over $100. Pretty good but still expensive after already buying a computer! I found out I could get a pretty good discount through work but a discount still means I’m paying for it. That’s when I remembered an article 9 Tips to Save Money on your Next Computer which mentioned OpenOffice.org!

I was a little skeptical of OpenOffice.org at first. I mean, it’s touted as a free alternative to MS Office. Could it really be as good if it’s free? I’ve used another alternative, Google Docs, a bunch of times. Google Docs is also free and is nice in that you can access your docs on any computer where you can get Google. It’s got good programs but falls behind in what MS Office offers.

OpenOffice.org , on the other hand functions almost exactly like MS Office!! So here’s our story: Last week my daughter had a science project due. In true fashion we all waited to just about the last minute. I hadn’t bought MS Office and didn’t use OpenOffice.org yet. We needed to print out her project, titles, and a graph of her research. Uh-oh! So I went to the OpenOffice site and downloaded thier suite which includes Writer (Word), Calc (Excell), Impress, Draw, and Base. I gotta tell you. I was surprised to see that it looked and operated just like MS Office would! I am sold! On top of the great programs you can also download templates and extensions to help you further.

Here’s the welcome page when you first open it:

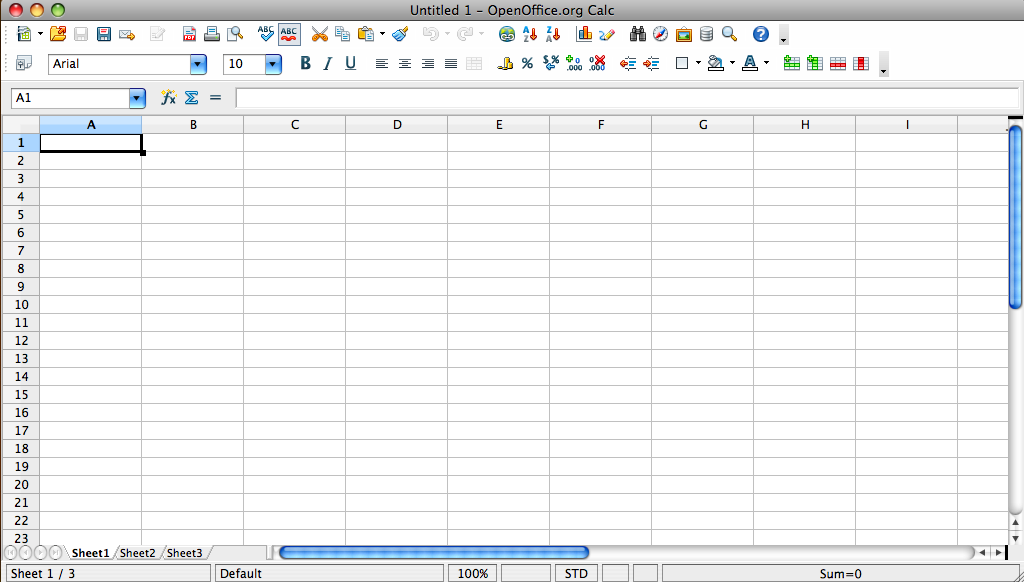

Here’s what a spreadsheet looks like:

Looks an awful lot like Excel, no?

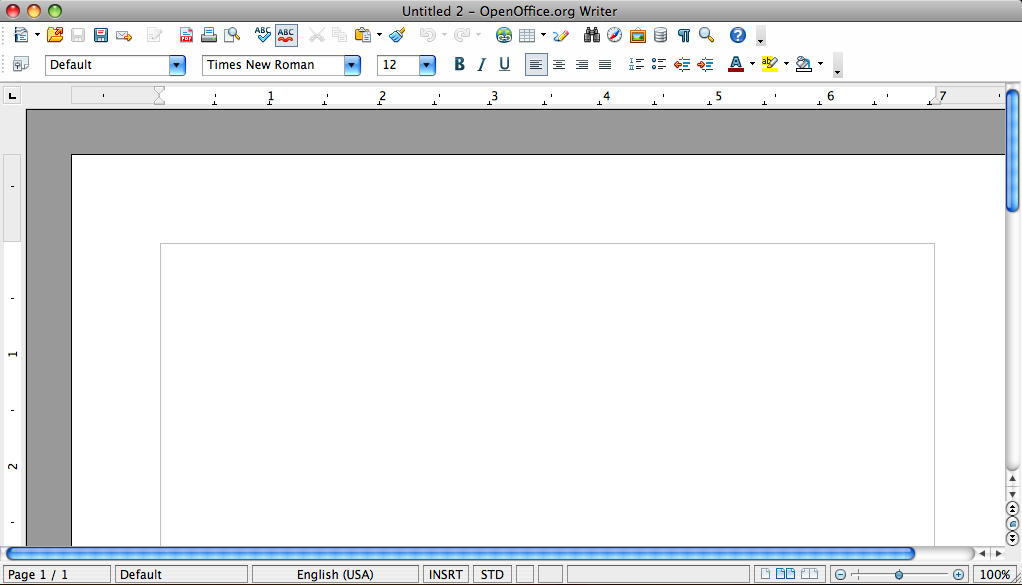

Here’s what Writer looks like:

Very similar to Word!

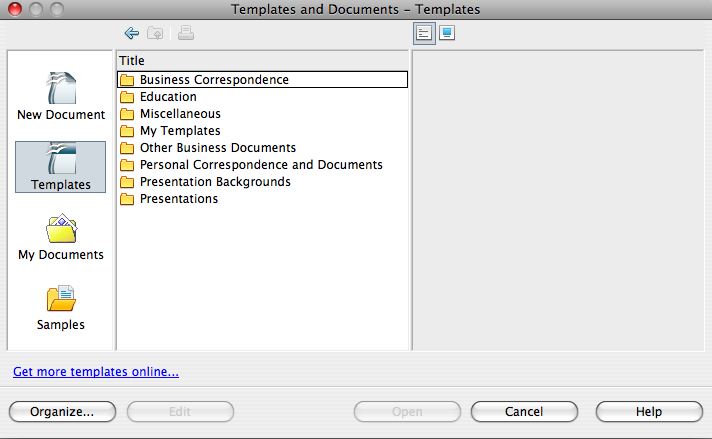

And here’s the templates and extensions screen:

There are a ton of great templates to chose from!

I mean, whats more frugal than free?!? And with the functionality of MS Office products it’s really a no-brainer! Although I haven’t gotten to use it too much yet I’m really liking it so far!

If you are looking for a spreadsheet, document, or presentation program I really think you should give OpenOffice.org a shot before you go out and buy anything!

Have you used it? What do you think?