Bank routing numbers, or “routing transfer numbers” (RTN’s) appear on virtually all of our checks and other demand instruments, but as common as they are most of us have no idea what their purpose is.

Occasionally we’re asked to provide our bank’s routing number—such as for direct deposit of income tax refunds—but this does little to clear up the mystery behind them or why they’re so important.

Think of it this way: each of us has a checking account number—the bank has its own identification number, and that’s the bank routing number. That number is at least as important to the bank as our checking account numbers are to us.

Where do you find a bank routing number?

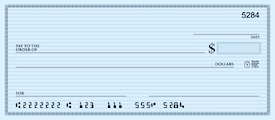

If you look at the computerized number line beginning at the bottom left of your personal or business checks you’ll find the bank routing number—it’s on all checks and other negotiable instruments.

The first nine digits of that line of numbers is the bank routing number. After those nine digits are a colon, and then the computerized version of your checking account number appears, followed by the check number.

The entire row is set up to be in machine-readable format (that’s why they have that funny font you don’t see anywhere else except maybe a sci-fi movie).

You may also find it online in your bank account. Some banks list it in an obvious place like ING Direct. Other banks you have to go digging around a bit (in which case finding the routing number on a check may be better).

The basic purpose of bank routing numbers

Bank routing numbers were created to allow for automated processing of large numbers of paper checks and other negotiable instruments. This is why they appear in machine readable formats.

The numbers were first implemented in 1910 by the American Bankers Association as a way to enable the processing of millions of paper checks.

Today, every financial institution in the United States has at least one of RTN and they are only for transactions within the US. Due to mergers and locations in multiple states, many large banks now have several routing numbers.

(Related: Free online checking accounts you should check out)

What do the numbers mean?

Though bank routing numbers may appear entirely arbitrary to us, the sequence and specific numbers have definate meaning.

Though bank routing numbers may appear entirely arbitrary to us, the sequence and specific numbers have definate meaning.

Each RTN has nine digits.

The first four numbers are Federal Reserve identifiers. The first two indicate the Federal Reserve Bank district (there are 12), the next two represent the Federal Reserve Bank district branch—or Federal Reserve check processing center assigned to your bank.

The next four numbers in the sequence identify your bank—that is, they are the identifying number your bank is assigned, much like your own checking account number.

The ninth and final digit is a classifier, indicated check or other negotiable instrument.

So from those nine digits, the check processing system can determine the federal reserve district and processing center, the financial institution the check is drawn on (your bank), and specifically what type of financial instrument it is (check or otherwise).

The routing number thus removes the need for human eyes in the processing of the checks—everything that’s important is contained in the number.

(Related: What do credit card numbers mean?)

When we need to use bank routing numbers

Even though bank routing numbers are for institutions, there are times we need to provide them.

As mentioned earlier, setting up direct deposit of income tax refunds is one common need for bank routing numbers, but there are others where it may be necessary:

- Direct deposit of payroll checks

- Automatic bill payments

- Wire transfers

New employers typically ask for a canceled check from the institution you want the money deposited into because the check contains not only your checking account number, but also the routing number. Both need to be precise—if the sequence if off by a single digit, your money will go someplace else.

Checks are the easiest place to find both numbers.

Always be careful that who it is you’re providing your checking account and bank routing numbers to is an absolutely trusted source. Anyone who has both numbers is in a position to not only to clean out your bank account, but also to engage in identity theft.

Those numbers transfer an incredible amount of information!

I never knew that! Thanks for sharing.

I didn’t know what each number meant but I knew the purpose as a whole. I never really thought of the fact that giving a cancelled check is basically giving away your account and routing number even though deep down I knew that they were both there.

Great post and info. I’ve never given these routing numbers much thought interesting to learn the background.

It’s great to read a blog post about routing numbers and provide sufficient information about it. I worked as a customer service representative for a credit card company and I learned everything I thought I needed to know about checks and checking accounts during our training.

This makes no sense to me; “Always be careful that who it is you’re providing your checking account and bank routing numbers to is an absolutely trusted source. Anyone who has both numbers is in a position to not only to clean out your bank account, but also to engage in identity theft.”

Every time we pay with a check those number are printed tehre, so any one that receives a payment witha check can steal those numbers, banks would have not printed then there if it was that sensitive. I guess scammers will need extra information to be able to engage in identity theft. I think anyone that have my account number can deposit but not withraw, unless they print fake checks, but again that can happen to anyone that pays with checks. I don’t understand why if that information is THAT sensitive, it is printed on every check for anyone to steal.