If you’re a faithful news follower, you’ve likely heard about the recent LIBOR scandal but like many, you might not know anything about LIBOR or the why the scandal is big enough to make international news.

What is LIBOR?

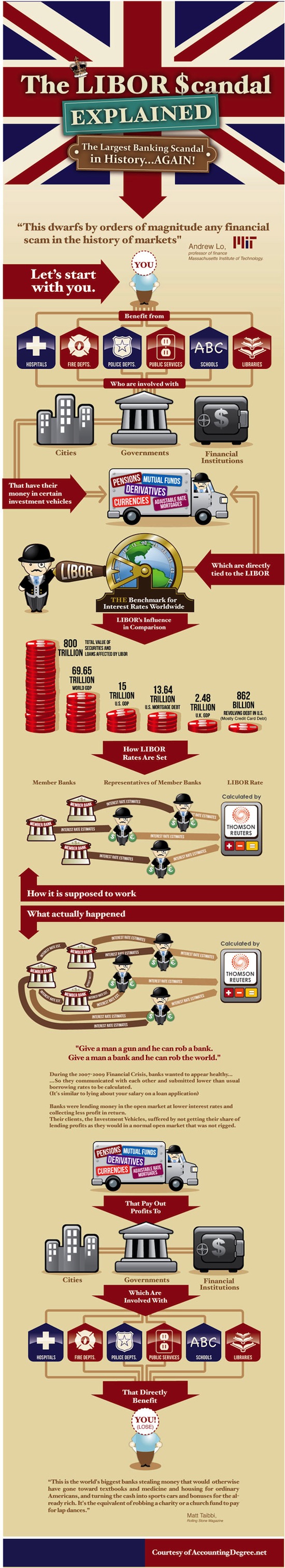

LIBOR is an acronym for the London InterBank Offered Rate.

Here’s how it works: Banks, just like other businesses, sometimes need extra money. Let’s say that Bank A wants to make a large commercial loan but to lend the money would put them below certain capital requirements but only until other payments and deposits come in.

Bank B happens to have an excess of cash on their books and as any good banker knows, cash sitting around doesn’t make any money so they’re eager to lend some of their cash. Bank A and Bank B come together and work out the terms of a short term loan, but how do they agree on an interest rate?

That’s where LIBOR enters the deal.

LIBOR is the UK version of the Fed Funds Rate. It’s the rate that one bank charges another bank for a short term loan but it doesn’t stop there.

LIBOR is used to set everything from mortgage rates to futures contracts. There are numerous LIBOR rates calculated in varying currencies by Thompson Rueters. The calculation is an average of the middle 50% of reporting banks. Each rate has a different amount of reporting banks but no rate has more than 20.

In total, about $800 trillion falls under LIBOR. To put that in to perspective, the total value of all goods and services produced in the world is only about $70 trillion.

The effects of LIBOR on the world’s money is massive!

The LIBOR Scandal

Between 2007 and 2009 banks were not well liked and investor confidence was low. In an attempt to paint a healthier picture of their strength, they communicated with eachother and reported lower borrowing rates than were actually true. This would be no different than AT&T and Verizon communicating to set the price of their contracts.

But since they set the rates lower rather than higher, that’s a win for the consumer, right?

Not at all.

Because the rates were lower, some of your investments likely didn’t make the money they should have. Pensions and mutual funds with certain investments didn’t earn the dividend payments they should have and that resulted in your retirement account essentially be robbed of profit it deserves.

These same pensions also help to provide an income source to municipalities that fund schools, public safety, roads, and hospitals. None of these establishments received as much money as they should have and that also affects you.

Finally, during the price fixing, it’s alleged that investors had knowledge of these efforts and were able to make large amounts of money trading the difference between the real rate and the published rate.

Bottom Line

How big the LIBOR scandal becomes is still unknown but some experts are calling this one of the largest financial scandals in recent history.

What do you think of the LIBOR scandal?

Want to learn more about the scandal? Take a look at this infographic.

My girlfriend had a student loan tied to the libor rate so I guess it worked out in her favor. Her interest rate was crazy high back then and to think it should have been higher is a sad thought.

Glad to hear it worked out for your girlfriend. Still, it’s crazy that such a widely used figure could be manipulated.

The only regret they have is that they got caught. I think this happens all the time in finance and various markets. The stock market is as crooked as a barrel of fish hooks, if you ask me.

Over the last few years or so we’re seeing more and more large-scale scandal, aren’t we?

The LIBOR scandal cost the jobs of at least 2 top bosses at Barclays (both of them having denied knowing anything about the wrongdoings). I suspect more will follow, not only at Barclays, but in other banks too once more revelations are made.

It will certainly be interesting to see what the fallout is. Hopefully the powers that be take this scandal seriously.

Love the infographic, is it any wonder many people hold the banks in such contempt?

Most of these banks are not doing anything to endear themselves with the masses. And you hear about profits at the same time the economy is bad.

I am so glad they got caught manipulating the LIBOR and will likely be punished. What would really be awesome is if someone actually went to jail for perpetrating this massive fraud. A small fine is hardly any deterrent for someone making billions from the fraud.

I agree. This is crime on a massive scale and should be treated as such.