Have you heard of the Grow Your Dough Throwdown?

Imagine being able to pit your investment prowess against other people for a year to see whose investments came out on top. Those other people are personal finance experts too, so they just might know how to handle money.

Sounds like it would be fun, right? Well, I think so. That’s why I’m taking part.

The Grow Your Dough Throwdown – Proof Investing Is Easy

Jeff Rose created the Grow Your Dough Throwdown. He asked a bunch of personal finance bloggers to join him in the challenge and to help spread the word. Here’s what the Throwdown is all about…

The goals of the throwdown are four-fold:

- Show how easy it is to invest

- Give a glimpse into the many options you have to invest

- Present a number of different plans you can use when investing

- Help make you understand that you can invest on your own.

For the challenge you can invest $1,000 any way you want.

You can make all the trades you desire, you just can’t add additional money. The challenge will take place over the course of 2014 with participants checking in from time to time to let readers know how they are doing.

I know from personal experience that as easy as it can seem, the deluge of investing options can be mind-numbing.

I first started investing through a 401(k) at my old employer. And that took my a while to finally sign up for, mind you. But I wanted to put money into investing long before that.

The problem was I didn’t know where to start.

Do I put money into an IRA? A Roth or a Traditional? What about an account that’s not retirement? Should I do mutual funds? Maybe ETF’s? Bonds? Individual stocks? What should I watch out for? How do I make my money grow? What about all these bubbles that keep bursting?

It can drive you mad. It certainly drove me to not do anything for some time.

And that’s too bad. Time is one of the greatest tools you have on your side for building wealth. The sooner you start the more time you have for wealth to grow on itself.

The best time to invest was yesterday. Next best is today. Tomorrow is too late.

Thankfully I did eventually put money into my 401(k). And later I put money into other accounts including a brokerage account I use outside of my retirement funds.

I let myself get stuck in analysis paralysis instead of just jumping into investing. But you don’t have to.

Investing really isn’t that difficult. The most important thing, like much in life, is to start.

Investing really isn’t that difficult. The most important thing, like much in life, is to start. http://t.co/QzeDQ3cQIb via @freefrombroke

— freefrombroke (@freefrombroke) January 13, 2014

Below I’m going to show you what my strategy is with my picks and what broker I used to make them. You’ll see how easy it is to start investing.

My Team in the Grow Your Dough Throwdown

For the throwdown I wanted to have a little fun and be a little speculative. But I wanted to be practical as well.

I chose 10 stocks mostly from companies I use often and know a little about. Some I know a little more about than others, that’s where the speculation comes in. I’d like to think I’m using a strategy that’s parts Peter Lynch or Warren Buffett but without any of the intense research they both do.

Lynch is known for his theory of “Invest in what you know.” The idea behind this is investors should start their search for an investment in the things they know about. Is there a store you always shop at? Maybe that’s a good place to start looking then.

With Warren Buffett you have the idea of buying at a discount as well as buying a good company that you know that has long-term strength. I can’t say I use his theories on all my picks but they do flavor them (though I do recruit the Oracle himself for my team).

Here’s my team for the challenge (I’ll follow after with my reasoning for each):

Target Corp (NYSE: TGT)

Netflix Inc (NASDAQ: NFLX)

Starbucks Corp (NASDAQ: SBUX)

Boston Beer Company Inc (NYSE: SAM)

Google Inc (NASDAQ: GOOG)

The Walt Disney Co (NYSE: DIS)

Berkshire Hathaway Inc (NYSE: BRK.B)

Craft Brew Alliance Inc (NASDAQ: BREW)

Amazon.com Inc (NASDAQ: AMZN)

Whole Foods Mkt Ind (NASDAQ: WFM)

For each of these sticks I invested $100 (10 x $100=$1,000). That includes the commission cost of $2 for each buy for a commission cost of 2% (I’ll show you how I got such a low commission below).

I could have bought less companies and lowered my overall commission rate per stock but I like the idea of diversifying with ten companies.

Why I picked these guys.

Target

I shop Target all the time.

They really have a little of everything I might need from clothes to toys to housewares to food. And they have it all at decent prices too. I’m also getting a little speculative here. After the whole credit card fiasco I think people are down on Target. A lot of shoppers are upset about what happened. But I think consumers will forgive and forget and keep shopping there. Buying Target now might be getting it at a bit of a discount because of the bad press. We’ll see.

Netflix

Here’s another company I use often. We’ve been Netflix fans for years now.

We started out with their DVD plans after friends told us how great they were. It didn’t take long to hook us (we love watching an entire series one after another without commercials!). We now have the net streaming plan. Besides shows and movies my wife and I love they also have a huge selection of eye candy for the kids. Oh, and Orange is the New Black? Hilarious and touching. Netflix took their service and are now making themselves into a network. This could backfire for them if their shows aren’t up to snuff but it can also payoff big as it has been. For sure they will be getting more subscribers when season two of Orange comes out.

Starbucks

This one is my ace-in-the-hole. If I’m lagging in the competition at any time during the year I can simply head over to my local Starbucks, whip out my gold membership card, and buy more coffee drinks to prop up the stock. Just kidding, sorta.

Seriously though, ever since Howard Schulz came back as CEO the company has been doing better. He got them back on track. And even though you can throw a rock and hit a Starbucks in some towns there’s still room to open up more locations, especially internationally. You’re also looking at a company that sells an addictive, and delicious, product that gets consumed immediately. You always have to come back for more (unlike a refrigerator company where you don’t get another one for 20 years). Starbucks doesn’t have the best coffee but they do have the best consistent coffee (I personally think Dunkin Donuts tastes like sugar water and the quality of stores is all over the place). I pretty much know that if I can’t find a local specialty coffee shop then I always have SB’s as a fall back.

Boston Beer Company

If you didn’t already know these guys brew Samuel Adams beer. You could argue that they are either the biggest micro-brew or one of the smallest big breweries around. Either way they make good stuff. I drink micro brews for the most part, avoiding the typical big guys. I like taste in my beer. I know I can find Sam Adams in most places and there’s always a beer of theirs that’s good (I love me some Cherry Wheat). As they aren’t one of the big guys yet (Bud, Coors, Miller…) they still have room to grow and as long as their quality holds up I think they will grow.

There was a movie in 1984 that talked about what Google would become (no not Amadeus). Just kidding. But think of it, Google is everywhere and they keep growing. They not only changed search engines but also changed the email experience. You may not realize it but behind all of their free products is a ton of advertising. Companies pay to get their ads in front of the millions of click-happy eyeballs that use Google for search and email as well as the many other products they offer. Look at them. They have Google Glass which are glasses you can wear and go on the internet with and they are developing a self-driving car. If they start getting defense contract you better watch out. I want to make sure I’m at least an owner of the company before the T-series hunt us down (maybe that will save me, right?).

Disney

It would be enough to make money off of their classic movies and their theme parks, right?

We went to Disney World and I swear it was one of the most organized places I’ve ever been to. And everyone was nice! We had a ball there. They know what they are doing. But that’s not it with them. Over the last few years or so they’ve added Pixar, Marvel, and Lucasfilm. What?!? They also own ABC and ESPN, among others. It’s like every time you think they are done they acquire another brand and you just think “wow, that’s perfect for them.” This year has a new Muppets movie that I know I’ll be taking the kids to see. And in the fall there’s a new Star Wars animated series coming out.

Yeah, this is a company that’s all over my household.

Berkshire Hathaway

If you can’t beat ’em join ’em, or so the saying goes.

If you want to invest like Warren Buffet then one of the best ways is to buy into his company. And that company is Berkshire Hathaway and it has historically done super. Technically Berkshire is an insurance company but really it’s like an umbrella company. If you thought Disney had a lot of properties under its belt check out what BH owns: GEICO, Fruit of the Loom, Helzberg Diamonds, Dairy Queen, The Pampered Chef, Benjamin Moore, and others. They also have shares in Heinz (they own half), Mars, American Express, Coca-Cola, Proctor & Gamble, Goldman Sachs, and more. I bought their ‘B’ share , or rather most of a share. Their ‘A’-class shares are far more expensive (though I guess I could have bought a teeny-tiny fractional piece of it).

Craft Brew Alliance

Another beer company. This one is a little more speculative as I don’t drink their brands too often, though I have had a bunch and liked them. Their brands include Red Hook, Widmer, Kona, and Ommission.

Amazon

When you think of buying stuff online Amazon is one of the first companies you think of. I love Amazon. I’ve been an Amazon Prime member for a couple of years or so and it’s great. You get good prices and 2-day shipping on most products. And believe it or not I’ve even found their customer service to be really good. When I’m looking to buy something they are the first place I tend to look. Why leave the house, especially with four kids, when I can get what I’m looking for delivered in 2 days?!? With the retail company you also have their Kindle brand and their cloud services. Did you know they also provide a lot of website infrastructure?

Some might say that their margins are tiny since their prices are so low and new competition pops up every time another company improves its shipping. But every year Amazon grows and online shopping in general grows. I’m happy to jump on their bandwagon and watch my portfolio grow with them.

Whole Foods

Whole Foods carries great food. We’ve been shopping there for years and every time we go there it’s like we’re in a candy store there’s so much we want to get. Unfortunately we don’t live close to one so we don’t shop there too often. That also tells me they have plenty of room to grow. For a supermarket there really aren’t a lot of them, not like other chains. The other reason we don’t shop there too much is we end up spending a whole lot. They don’t call it “whole paycheck” for nothing. Because they sell more organic and natural lines of food that you don’t see in other stores they can charge a premium and not worry so much about big discounts or coupons. That’s a good thing as a stock holder. And I really do love their selection of beer and coffee (I’m starting to see a bit of a pattern here). A potential problem with the company is the rise of natural and organic foods in public awareness. It used to be you either went to a small specialty store or Whole Foods to get that kind of stuff but you’re seeing more major supermarkets take notice and stock these items.

That’s my stock team. What do you think?

At this point I have to make sure you understand that even though most of these companies would be long-term purchases for me this isn’t representative of my entire portfolio. These companies are somewhat speculative and are fun picks for me.

I have another account with similar types of companies in them but the money I put in isn’t my major investing. Most of the money I put into investing goes into broad sector funds or ETFs in our retirement accounts. Don’t take these picks as any sort of investment advice.

The Brokerage I Used to Invest

To make these investments I used ShareBuilder.

Part of it was that I already had an account with them so I knew how easy it was to invest with them. I love that they are connected with Capital One 360 and I can easily transfer money to my investing account (they are both owned by Capital One).

They also don’t have any minimums to open an account and don’t charge any inactivity fees. You can also choose to have your dividends automatically re-invested into more shares (great way to build up your portfolio over time).

Another reason was to keep commission costs down.

Commissions, or what you pay to make the investment, can be a silent killer, especially if you do a lot of trading. When you buy a stock (or a fund or ETF) your investment has to increase enough to cover the commission costs before you have really made any money. High commissions mean your stock needs to “work harder” before you see anything out of it. If you’re investing long-term and don’t plan on selling for a while then this may not be as big an issue (and also if you don’t add to the position often). But anything short-term and you want to cut that commission cost down as much as possible (heck, you always want commissions to be as low as possible). I may keep these stocks for the long-haul but since this throwdown is only a year I want to make sure I give myself every chance I’m able.

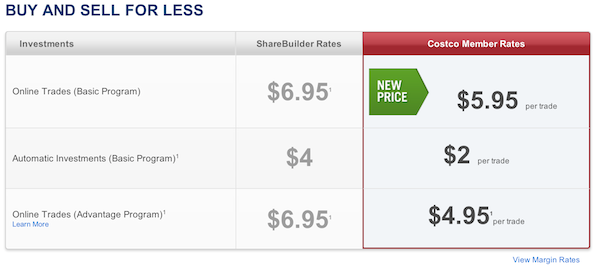

Real-time stock/ETF trades are $6.95 with ShareBuilder. While not the lowest in the industry it’s still a pretty low fee.

But I used ShareBuilder’s Automatic Investing plan.

With that plan trades are only $4. That’s a pretty low commission fee. The thing with the Automatic Investing plan is you only invest once a week, on Tuesdays. You have to have your plan set up on Monday by 5pm EST. What ShareBuilder does is pool everyone’s investing and make all the investments at once for everyone. This saves for them as well as for the investor. It’s why they can charge $4. I’ve made a lot of investments in the past with this plan.

You can set up the Automatic Investing plan in a few of ways. You can do a one-time plan which, as the description sounds like, is a plan you set up to only go through once. You can also set up plans to invest at intervals like every month. There’s another option that’s really nice for a beginning investor where ShareBuilder will invest once your money in the account hits a certain threshold (good for when you transfer money in like every week or so). I used the one-time option here since I made all of my investments at once.

Another great feature of the Automatic Investing plan is it will buy you fractional shares.

What kind of shares? I’ll explain.

For the investments above I put $100 into each company. As you might be able to guess the companies didn’t sell at $100. Some were less, and I got more shares, and some were more, and I actually got less than one share. Fractional shares means you’re buying less than full pieces of shares.

For example, for Craft Brew Alliance I was able to buy 5.7891 shares at a cost of $17.27/share. For Google I only bought 0.0864 shares at $1,157.41/share.

If the numbers there make your head spin then here’s what’s really important — you can invest any dollar amount and get as much stock as your money allows (minus commission).

I’ll be going into more detail and walk you through opening an account and setting up a plan in a future article.

Here’s our detailed review of ShareBuilder if you’d like to learn more about them.

The Costco Executive Bonus

Here’s where it gets real sweet! If you have a Costco Executive membership you can get lower prices on your trades. Costco is full of discounts like these, you just have to find them on their website. (Hint: Scroll down to the bottom of the Costco site and click on Costco Services. That will take you to another page with an option for online investing.)

Here’s how the prices compare when you’re a Costco Executive member:

Your real-time trades drop to $5.95 making them very competitive with other online brokers. But I think the real benefit is in getting $2 Automatic Investments! Now that’s a low commission.

I’ll have more details on how to get this discount in another article (stay tuned!).

I know there are all sorts of brokers out there and people will be making different investments in this throwdown but I’m thinking many will be paying higher commission fees than $2. That gives me an advantage right there. And heck, it gives me an advantage without any competition.

Tracking My Investments

I could just check my account in ShareBuilder to see how my picks are doing. Because I opened up another account with them I can see these picks separate from my other investments there.

But I want to try something new.

I plan on opening up a Personal Capital account. We’ve reviewed Personal Capital before and I heard great praise from them all over.

One great service Personal Capital offers is giving you access to their wealth management services without having to have millions in investments and at a decent price. But they also offer a free service that lets you track all of your investments across different brokers in one place.

That’s super convenient, especially when you have a lot of accounts.

Final Word on Investing and the Grow Your Dough Throwdown

I hope you can see that it’s pretty easy to invest if you want to. And I hope you see it doesn’t take a lot of money either.

Really, you can start investing for $100 or even less. So you know, the account I opened could have easily been a retirement fund as well.

The investing throwdown will be fun.

I’m looking forward to reading everyone’s strategy and seeing how it works out. I think it will be educational for me and you too. I’ll make sure to update on how my investments are doing over he course of the year. Make sure you check back to see how I’m doing.

Do you want to join the throwdown? Open up an account with $1,000 and follow along and let us know how you compare.

What do you think of my strategy and picks? Tell me your opinions in the comments!

Here are some of the other challenger articles:

Could a Blindfolded Monkey — Throwing Darts at Stocks — Beat the Experts? | Afford Anything

Grow Your Dough Throwdown: My Investment Picks – Working to Live Differently

Grow Your Dough Throwdown: My Dividend Portfolio

The Grow Your Dough Throwdown Best Investor Challenge

The Grow Your Dough Showdown – My Investment Pick – Investor Junkie

The Grow Your Dough Throwdown: My Investments – Canadian Finance Blog

Young Finances Joins Investing Challenge

My Investment in the Grow Your Dough Throwdown – Frugal Rules

Grow Your Dough Throwdown – Consumerism Commentary

My Approach to Stock Speculation in 2014 [Grow Your Dough Throwdown Part 1] – PT Money

Hopefully you bought TGT after their issues with the CC breach. While I like the company overall and would buy shares of them at the right price. I still feel they are too expensive.

AMZN I wouldn’t touch with a 10-foot pole. Great company to buy from, poor company to invest in.

What about taking a look at the actual valuations (Buffett) of these companies?

Investing has never been a difficult feat at all. Rather, it’s deciding on which would be profitable investments that always gives a kick in the head. Just because a company is “seemingly” running smooth operations doesn’t immediately make it a good company to invest in. It will always take more than just a little research (but probably lesser time than it takes for women to pick clothes).

I think the investment throwdown would make for a great source of knowledge and experience for the beginners though. As they all say, experience is the best teacher!

Thanks for the list. That’s helpful. I have invested in some of them and I’ll invest in some more from the list. Berkshire Hathaway is one of the stocks I’ll always put my money into. Two others from the list that fascinates me always are Google and Netflix. I’m interested in Target and will keep the stock on watch. Thanks again for the guidance.