Having a good credit score impacts many areas of your life: the interest rates you pay on debt, your car insurance rates, and what types of credit card offers you get in the mail.

If you find yourself with a poor credit score, but have a need to improve it quickly, there are a few tips you can try.

However, the only true way to drastically improve your score is to use debt responsibly for a long period of time. There are some ways that can help speed up how you improve your credit score. Do these right and you might just raise your credit credit score by 100 points fast!

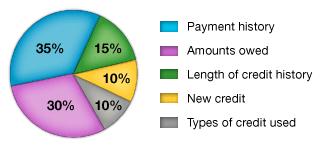

What Goes Into a Credit Score?

Before you can improve your credit score you need to know what exactly goes into your credit score in the first place. Once you know what goes into the credit score you can work to make changes in those specific areas.

We have a full post that dissects what goes into your credit score, but here’s a brief breakdown:

We have a full post that dissects what goes into your credit score, but here’s a brief breakdown:

- 35% – Payment History

- 30% – Amounts Owed

- 15% – Length of Credit History

- 10% – New Credit

- 10% – Types of credit used