Lending Club is an online website that offers a unique borrowing and investing model to individuals who need funds and those who are looking to make some money.

Credit-worthy, pre-screened borrowers are paired up with savvy investors in what Lending Club calls a win win situation for all. Peer to Peer or Person to Person lending is the basis of the site. Investors sign up to make money and borrowers sign up to reduce their cost of paying back debt. In summary, investors fund loans for approved borrowers. Borrowers save over bank interest rates and investors profit with returns as high at 9% annually (about the average).

Information for Investors

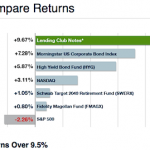

Investors make their money from Lending Club when they invest in 3 to 5 year notes. Investors get to choose which notes they want to purchase by looking through selection criteria. Once you purchase a note you will then begin to receive monthly payments directly from Lending Club as the note is being paid back by the borrower. Lending Club will take 1% of each payment for their fee and you get to keep the rest. You make your money on the interest collected. Since 2007, when Lending Club was launched, investors have earned, on average, a net annualized return of 9.5%.

[Read more…] about Lending Club Peer to Peer Lending for Investors and Borrowers – Review

Have you seen the commercials for the ZYNC Card from American Express?

Have you seen the commercials for the ZYNC Card from American Express?