It’s awesome when you see your investments going up!

It’s the kind of feeling that makes you feel powerful; invincible even.

And when your investments go down you feel a pit of despair in your stomach. “Please go back up some so I can sell and I’ll never invest like that again,” you plead to the investment deities.

Of course this is all good reason you should carefully invest. It’s not hard to do but if you don’t have the stomach to see your investments fall in value then you’re better off investing in broad sectors (like the S&P 500 or all stocks). Honestly, most people aren’t that great at picking stocks so your best long-term plan is to stick to sector funds and ETFs. And even then you might not want to look at your picks too often.

About a month and a half ago I jumped into the Grow Your Dough investment challenge.

This challenge pits a growing number of personal finance writers against each other for a year to invest $1,000 and see whose investments would come out on top.

I chose to pick individual stocks.

If you take a look at the other people in the competition you’ll see a number of different investing strategies. It’s pretty cool to see how everyone interpreted the challenge.

Let’s take a peek at how my choices are doing and if I should jump for joy or bury my head in the sand.

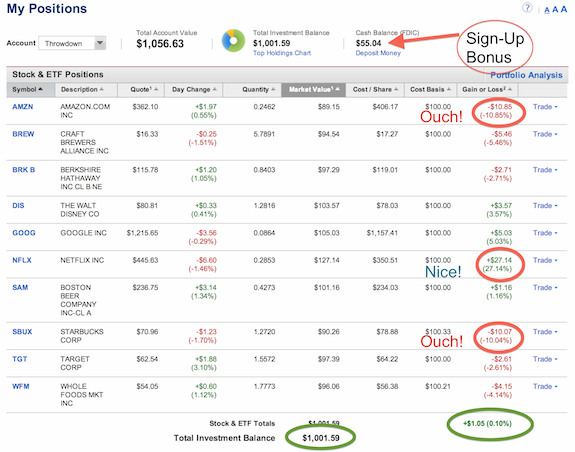

I took a snapshot in ShareBuilder of my investments through February (I took it after the markets closed on February 28th).

Before we go dissecting this understand I made my investments on January 13th. This portfolio has been around for about two months (though we’re looking at a snapshot that’s a bit younger). I wouldn’t normally look at my investments so soon but this is a challenge so we gotta show what we got.

You’ll see based on my snapshot that my portfolio has gone up a monumental 0.10%. Not a lot, huh?

But let’s take a closer look.

I started out investing $1,000. I bought 10 different stocks and paid a $2 commission for each buy which cost me $20 when all was said and done.

From day 1 my portfolio was already down to $980 because of commission costs. This is an important aspect that I think a lot of people forget about — you have to consider trading costs. If you trade a lot you eat into your investments. In order for your investments to earn money for you they have to first earn back the commission cost. I opened a ShareBuilder account through Costco to get $2 trades which is very low.

My portfolio has grown about 2% which is just enough to earn back the commission costs. It’s a good start.

Diversification is Important

Another thing to notice is the overall portfolio is at 0.10% but when you look at each individual investment then you see it’s all over the place.

You’ve got some small ups and downs among the stocks and a couple of bigger losers and a big winner so far. Part of my strategy was to pick 10 companies rather than just a few so that I could better smooth out the ups and downs of the market with some diversification. Sure, having that one big winner is great but the truth is you don’t know which pick will be that big gainer.

Here my big winner so far is Netflix (up 27%). If I only picked a few investments I could have easily picked Amazon (down 11%) and Starbucks (down 10%), which are also my bigger losers so far.

Don’t Get Too Hung Up On the Day-to-Day

We’re looking at my portfolio now but I don’t normally check my investments too often. I try to make picks that I think will grow over time, that I won’t have to worry about selling anytime soon.

Wrapping Up

Remember, these are real investments but the challenge is for fun.

I do have another investing account where I invest in individual stocks and some ETFs but the bulk of my investing is in sector funds and ETFs in my retirement accounts.

This is only the first update. We have the rest of the year to watch my picks grow (they are going to grow, right?). It should be a fun ride.

I never realized you could sign up for Sharebuilder from Costco and get $2 commissions. Is that just an introductory rate?

Have you used LOYAL3?

To be exact I have an Executive membership from Costco and that’s what gives me the $2 commission. That’s also for their Automatic trades, not real-time trades (which is fine for what I’m doing). This isn’t an intro rate.

I’ve heard about Loyal3 and their free trades. I’m actually looking into them to see what they are all about.

I’m looking into loyal 3 right now for free commissions on automated trades. Sounds too good to be true. Hope it isn’t.