It was just a little while back that I updated you on my Sprint SERO plan. Now it seems the Sprint SERO plan is no more. To recap, the Sprint SERO plan was an employee referral plan that offered great rates and included unlimited data (read internet) and unlimited texts. For $30/month you got 500 minutes and unlimited data and texts. All you needed to sign up was an employee’s email address and those were all over the internet! As I noted in my follow up we are saving at least $10-$20 over our last Verizon plan and the Verizon plan didn’t include data or texts (my wife and I both have a plan).

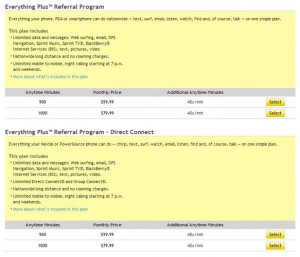

Sprint SERO meet your successor the Sprint Everything Plus plan. The new plan is now $59.99 for 500 minutes and $79.99 for 1000 minutes. For more minutes there’s the Simply Everything plan that’s widely advertised. So basically the 500 minute plan doubles in price! This may still be a bargain compared to other plans out there but not nearly the knockout punch it used to be. The new plans add GPS navigation and Blackberry Internet Services. The Blackberry inclusion could also still make the plan economical since some carriers charge extra for it.

But wait, there’s more! Or less really. Even if you think the new plans are still a steal they are much harder to sign up for now. Rather than just any employees email address you now need an employee’s email AND the last three digits of their employee ID (CID). So you may actually have to know someone to get into the program.

Don’t sweat it if you were fortunate enough to already be on the Sprint SERO plan. Existing SERO customers are grandfathered in on the old rates. Whew!

As I mentioned the plan may still be worth it to you but you really need to check out other plans as well. Look at all of the features and options and see what works best.

It’s sad to see the SERO plan go but I can understand why. They really did give a great package at an insanely low rate. The new Sprint Everything Plus plan puts the prices more inline with their Everything plan. I’m happy I was able to get in while I could!

Are you just starting off building up your savings? I’ve mentioned before that a great way to save is by putting money in a

Are you just starting off building up your savings? I’ve mentioned before that a great way to save is by putting money in a