It’s a common theme on the news and in the papers, the cost of virtually everything is going up and more and more families are finding it harder to keep up with monthly expenses, let alone what happens in an emergency situation, especially a medical one. As health care costs rise and medical insurance costs increase astoundingly fast, a medical emergency can complicate the finances of any family. It is especially tough on those who require prolonged medical care and prescription medication.

What happens when you need to seek treatment but do not have the money to cover the costs? For many, a seemingly easy fix is to pay on credit in order to get immediate attention but financially it may not make sense, especially if you do not have a cash plan to cover the monthly costs. In addition to failing health, you may be faced with long-term financial stress. By charging your health care costs to a credit card, you are going to end up forking over much more money than you otherwise would have to thanks to increased costs and potentially over the limit fees for any missed payments. Credit limits will also take you only so far. For prolonged treatment, your credit limit may quickly be maxed; not to mention the changes being made by the credit card companies which are reducing credit amounts and increasing interest charges.

If you have a credit card that offers a cash back rewards program based on purchases made, it might be beneficial to use it for the money coming back to your account or your wallet. However, that alone is not a reason to use your credit card for medical treatment. There are more viable alternatives for paying for medical care. If you are unable to come up with the cash for payment, perhaps the following list can help you find other options.

Start An Emergency Fund

Even if you don’t anticipate an illness occurring (who does?), you can make a point to have a small amount of money each month transferred to an interest-bearing savings account, where it can grow and be available for medical emergencies. With insurance, there are many times that the costs not covered can still run high and it can be a great relief to have access to cash in the event a medical situation arises, especially one that requires a hospital stay or long-term medication.

Check In With The Government

There are many medical assistance programs available in communities and on a federal level to help supplement your medical payments. Many people will not consider asking for assistance whether due to pride or just lack of knowledge. There are also many clinics that base payment rates on your income and expenses. You can often get quality medical care for a fraction of the cost if you make the effort to seek out additional help.

Payment Plans With The Treating Facility

Most health care providers will offer some options for a payment plan, depending on your need. Even if you have to make payments for a long period of time, you will likely end up saving money by eliminating interest charges like those tacked on to a credit card. If you don’t have insurance, or find that your insurance does not sufficiently cover all of your costs, the balance amount can be paid down over a period of time without collection action, provided you continue to make regular payments

Medical emergencies and unexpected illness are stressful enough. It is better to be proactive and prepared for the unexpected than to rely on your credit card to get you through your situation. Adding financial stress to physical stress can often be a fatal combination. As health care continues to be a major issue for many in the nation, it may continue to get worse before it gets better. No one can prevent an emergency but by proper planning, one can be prepared for it.

******

Tisha Tolar is a freelance writer providing content for CreditCardAssist.com, where she regularly writes about credit cards, rewards programs and general consumer finance issues.

******

Sign up with ING Direct and get a $25 bonus

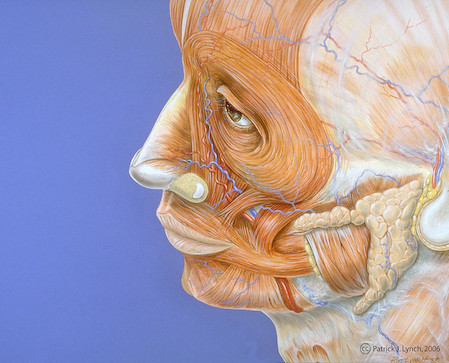

photo credit: Patrick J. Lynch